Pay TV operators to dominate market for online subscription TV

Thursday, September 12th, 2013Netflicked: Pay TV (Finally) Goes OTT

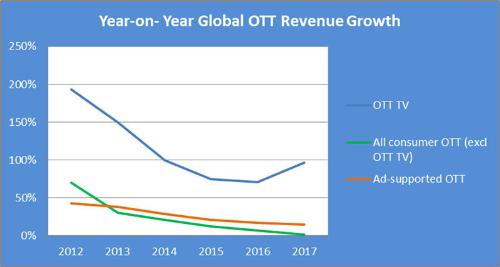

- Online Subscription TV Spending Set to Surge

BOSTON — Pay TV operators will dominate the rapidly evolving market for online subscription TV, heralding the end of the first phase of online viewing which saw the rise of on-demand specialists such as Netflix and ad-supported platforms such as YouTube. Strategy Analytics’ 2013 Global OTT Forecast highlights the growth in online subscription TV as the principle driver for OTT spending growth over the next five years. While online ad supported and subscription VOD spending have started to scale in leading markets such as the US and some European countries, online subscription TV is only just beginning to make an impact: Strategy Analytics believes global spending will accelerate to $4.7b in 2018 with the lion’s share concentrated in North America and Western Europe.

Ed Barton, Director of Digital Media Strategies (DMS) for Strategy Analytics, commented “We are entering a new phase in the evolution of TV distribution over the public Internet. Pay TV service providers are recognizing the defensive imperative in ensuring they have a major say in the development of online TV. Standalone online subscription TV addresses the holdouts who will not be swayed by traditional premium TV offerings by promising high quality content including, crucially, live sport, shorter commitment periods, a lower cost of entry and much simpler installation and hardware requirements than traditional, ‘full fat’ pay TV services.”

The most successful online TV subscription services will come from pay TV service providers leveraging existing content rights and broadcaster relationships with the UK’s Sky an early contender with the introduction of NOW TV at the start of 2013. Services from startup specialists such as Magine and Aereo will also generate strong growth (legal quibbles notwithstanding) and their expertise will make them prime targets for service providers who are late to the online TV party. Hence our belief that the next five years will see numerous firms jockeying for position in what is likely to become an intensely competitive marketplace for channel owners and service providers.

Barton added “While the next few years will see standalone online subscription TV services proliferate there are numerous issues the TV ecosystem needs to work through in the dash to deploy. Content rights and windowing will be impacted on a territory by territory basis while deployments will need to be designed in order to minimize cannibalization of the core pay TV business. We expect to see bundling of online TV subscriptions with network access deals and device sales in the drive to build customer numbers. Once these services are established in the marketplace spending will accelerate and that is when we will see the extent to which online subscription TV can truly impact the huge spending volumes pay TV delivers today.”

About the OTT Forecast

The 2013 OTT Forecast provides comprehensive market sizing and forecasting on all forms of OTT TV and Video spending to 2018 across 30 territories.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally