Netflix reaches 1.89 million Australians

Tuesday, August 11th, 2015

Foxtel loses share (but not size) as Netflix expands pay and subscription TV market

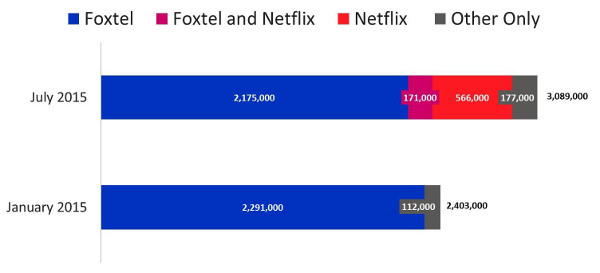

Netflix has hit 8% of Australian homes reaching 1.89 million people 14+ in July*, the latest monthly data from Roy Morgan Research shows. Over 1 in 3 households now have some form of pay or subscription TV, up almost 30% since the start of 2015.

At the start of 2015, the very idea of paying for TV content was practically synonymous with Foxtel. In January, 95% of the 2.4 million homes with Pay/Subscription TV market had Foxtel, and just 5% used only another service such as Fetch or Presto.

Enter Netflix, which has grown to 737,000 household subscribers in July, some 1.89 million people. This is a stellar increase from 748,000 people in April to 1.16 million in May to 1.53 million in June*. Netflix is expanding the category by luring new customers to paid/subscription TV—now in almost 3.1 million homes. Stan and Presto have also made gains in the number of households subscribing. So while Foxtel’s share has fallen dramatically to 76%, the size of its customer base is almost unchanged (2,346,000).

In July, 7.3% of Foxtel’s homes (171,000) were also subscribing to Netflix—a rate not much below the national Netflix take-up of 8.0% of households. The consistent number of Foxtel homes suggests that many of its customers are, for now at least, trialling Netflix as an add-on to their main Pay TV provider.

Estimated number of Households with Pay/Subscription TV service

Source: Roy Morgan Single Source, January 2015 n = 4,031 and July 2015 n = 5,056 Australians 14+.

* The final monthly figures for Netflix in May and June are slightly higher than the early indicators initially published. In May, Netflix reached 419,000 homes and 1,161,000 Australians 14+; in June, 571,000 homes and 1,533,000 people.

Tim Martin, General Manager – Media, Roy Morgan Research, says: “Our ongoing month-by-month research is already giving some early indications of the newly competitive pay TV marketplace.

“For many years prior to the arrival of Netflix, total uptake of pay or subscription television had remained steadily in the region of 25-30% of households, unable to break through to a wider audience. Clearly, there was plenty of space for the market to grow.

“In just four months, Netflix has expanded the total market up to over a third of all homes. So far, it appears Foxtel hasn’t been damaged by the arrival of Netflix. It may turn out to be that the two are not direct competitors after all: Foxtel subscribers will view Netflix as an add-on provider, and non-subscribers were never going to get Foxtel anyway.

“As our sample of subscribers grows, we will be able to dig deeper and deeper into the underlying differences between the target audiences and uptake of Foxtel, Netflix and other providers.”

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge