Wurl releases U.S. video viewing index

Friday, September 25th, 2015

Wurl Releases AMOV Video Viewing Index

- First standardized measurement of usage for video services across U.S. population

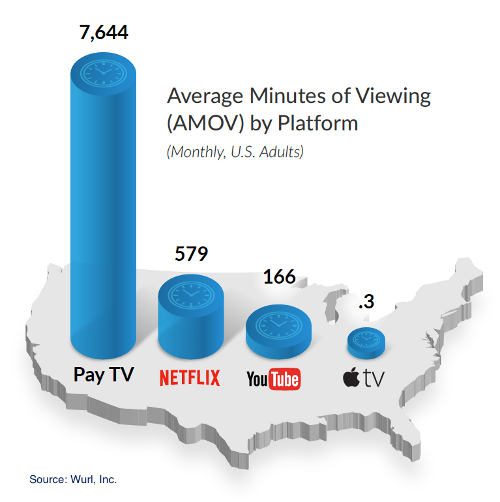

PALO ALTO, Calif. — Wurl, Inc., a streaming video platform for pay TV, today announced a new video index that compares the usage of major video viewing services based on publicly available data. The index, referred to as “AMOV,” measures the average minutes of viewing by U.S. adults on each video platform, taking into account both usage (minutes of viewing) and reach (percentage of U.S. adults that use the service). The AMOV Index measures viewing on popular services like YouTube, Netflix, pay TV, Apple TV and many others.

The growing use of streaming video services, a proliferation of new devices for video viewing, and the declining use of pay TV have made it increasingly difficult for video publishers and advertisers to analyze the relative importance of each video distribution platform.

The Wurl AMOV Index provides the industry’s first and only yardstick for how much video the average U.S. adult consumes on platforms like pay TV, connected devices and new streaming services. The index is fully transparent, providing detailed information about the “AMOV math” behind each platform in the index, and open, wherein Wurl invites authoritative sources to provide new data to update the AMOV Index. The index and the underlying data are publicly available at wurl.com/amov.

“The importance of any video distribution platform is directly related to how much it’s used. Generally available information about real usage is difficult to find, confusing and in some cases misleading,” said Sean Doherty, CEO and Co-Founder of Wurl, Inc. “To make informed decisions, market participants need a standard way to quantify penetration-adjusted usage for any video service.”

A Tool for Better Decision Making

While some platforms have a large installed base but very low viewing time (e.g., smart TV video portals), other platforms have high viewing time but a small installed base. Market participants need a reliable yardstick like AMOV that takes into account how many consumers use a service and how much they use it. For example, a service that’s used 10 hours per month by 65% of U.S. Adults would receive an AMOV of 6.5 hours per month.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally