Five developing markets offer opportunity for Netflix

Friday, September 25th, 2015

Futuresource Consulting – What Next for Netflix?

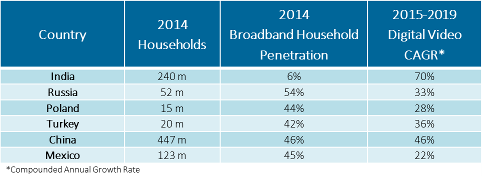

As Netflix continues on its quest for global coverage, where are the next wave of opportunities for the service provider? Recent research from Futuresource Consulting identifies five key developing markets which present significant opportunity for Netflix and the wider digital video landscape.

Netflix has enjoyed enormous success in developed nations and is now looking to emerging markets for continued growth. The advent of digital video is fuelled by growth of broadband infrastructure and connected devices, combined with limited penetration of digital TV services. Such a scenario provides Netflix (or other digital video service) with great potential to establish a robust footprint. Futuresource entertainment analysts take an in-depth look at some of these growth opportunities.

India

“The Indian digital video market is rapidly emerging,” comments Joanna Wright, Senior Market Analyst at Futuresource. “As of 2014 it accounted for just 15% of home video spend, held back by lacking infrastructure and digital payment methods. Moving forward, compounded annual growths of 70% until 2019 will see digital video escalating in importance.” Wright predicts that by the end of 2016 will see the launch of Netflix or Amazon; cashing in on the enormous opportunity from the 1.3 billion populous. Poor broadband infrastructure is a current barrier to growth. However, with smartphone ownership rapidly approaching ubiquity in India and with an impending pan-India 4G launch from Reliance Jio, mobile is to drive digital video spend as well as solve the digital payment problem.

Russia

Futuresource Research Analyst, Tristan Veale explains that, “Despite the comprehensive barriers to digital video growth including endemic piracy and a depressed economy, the Russian digital video sector is rapidly expanding. Retail spend to grow by 37% in 2015 and is expected to more than triple by 2019.” Russia remains resistant to paid for access models with AVoD preferred to SVoD, as such an established and innovative EST sector in 2014 accounted for 39% of spend on digital video. The affluent Russian cities are well serviced by ISP’s while the rural population have little to no access. As such, despite apparent low country wide penetration and average speed, it serves the target market well enough that IP access isn’t a barrier for growth. Once the economy is back on track, spend on OTT will once again accelerate.

Poland

“Digital video spend is forecast to outstrip packaged media spend for the first time this year in Poland representing 58% of total home video expenditure with revenues of PLN 170 million ($ 53 million),” says Michael Boreham, Senior Market Analyst at Futuresource. Moving forward the expected entry of Netflix during 2016 is anticipated to provide a boost to the SVoD segment with spend rising to $84 million by 2019. Pay-TV VoD currently dominates the digital segment, it represented close to 60% of total spend during 2014. Moving forward it is the online video platforms rather than Pay-TV that will drive the digital video market forward.

Turkey

“The Turkish digital video market remains in its embryonic stages, with Pay-TV VoD and SVoD the only two components of any real significance, SVoD particularly so with an 85% share of consumer spend. A strong piracy and file-sharing culture has particularly restricted interest in the transactional digital market,” says David Sidebottom, Principle Analyst at Futuresource. Turkey’s large population, which has a comparatively high youth component (17% of the total population are 18 to 24 years old), growing broadband penetration (42% as of end 2014) and a growing appetite for all types of video content will provide a stimulus for digital video growth across all sectors; although it will be SVoD which is projected to dominate the market in the long term.

China

Despite the increased government control, China’s online video market continues to develop rapidly, with an increasing focus on creating and delivering premium, full length content, particularly from the leading players. Subscription services remain in their early stages of uptake, with most customers reluctant to pay for TV due to the wide availability of free content (either through ad-funded services or via file-sharing/pirated means). Wright comments, “There is huge investment in infrastructure which is helping to drive and support online video uptake including significant broadband growth and continued adoption of 4G services, with fixed broadband subscribers expected to reach 230 million in 2015. While of late there has been a slowdown of the Chinese economy, this isn’t expected to be a long term impediment to the meteoric growth of OTT video.”

Mexico

“The Mexican market exemplifies how developing nations can drive service growth. Mexico is embracing the digital revolution,” says Boreham. Netflix has driven SVoD since launching in 2011 when only 40% of households had broadband access and they’re now capitalising on the move, by the end of 2015 they will have 2.5 million subscriptions the fourth largest international market after the UK, Canada and Brazil. Looking ahead, increased availability and speed of broadband connections will help fuel the growth of SVoD which already accounts for 80% of digital retail spend. By 2019, the total number of subscribers is forecast to increase to over 8 million, equivalent to 39% of broadband households.utlook to 2019, profiling key regions and countries, and reviewing the major developments in terms of product features and competitive landscape.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally