Number of UK quad-play households to double in 2016

Monday, October 19th, 2015

Exclusive Programming to Boost Adoption of Multiplay Bundles in the UK

- Number of Households Taking Four Services from a Single Provider to Double in 2016

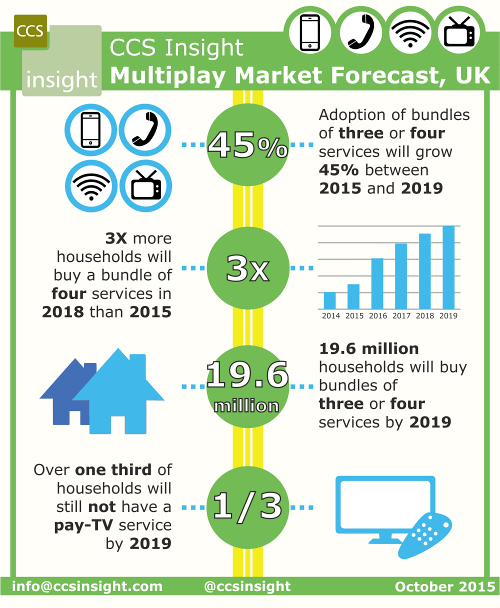

By the end of 2019, almost 85% of UK households will have signed up to bundles of at least two telecom and media services from the same provider. According to a new multiplay services forecast by global analyst house CCS Insight, multiplay services will continue to disrupt the market. Telecom and media companies will be forced to make new alliances and acquisitions in an effort to compete with market leaders Sky and Virgin Media.

Demand for services such as pay-TV, fixed line, broadband and mobile is clearly demonstrated in CCS Insight’s market forecast. In 2015, more than 12 million UK households will commit to a bundle of three services from the same provider. A further 1.5 million will take a bundle of four services by the end of the year, with value, convenience and fewer bills the main reasons for signing up. CCS Insight expects the number of households purchasing bundles of four services to double in 2016, and to grow steadily in the near future, helped by consolidation of the telecom market, such as BT’s proposed acquisition of EE.

CCS Insight believes there will be substantial growth in the uptake of pay-TV services, driven by promotional activities, the roll out of new services, the emergence of new providers and a proliferation of no-contract options like Now TV. Paolo Pescatore, Director of Multiplay and Media at CCS Insight, comments: “Over 40% of UK households currently do not subscribe to pay-TV services: this is a huge opportunity. BT has shown the way with the success of BT Sport. It’s now using its sport channels to drive up subscriptions to BT TV among its existing customers. It’s also targeting Sky TV customers who enjoy watching sports, while others like Virgin Media are positioning themselves as aggregators.”

“We will see similar battles in other types of programming beyond sport, fuelling further competition. We believe programmes, especially exclusive material, will be a key weapon in providers’ quest to secure customers. Those that offer a vast array of programmes will be better placed to succeed”, Pescatore continues.

Furthermore, unique approaches like Lebara Play will provide further disruption and force established providers to continue innovating. Adoption of fibre broadband will help online video-on-demand services like Netflix and Amazon Prime Instant. Pescatore comments: “These on-demand services pose a serious threat to telecom providers’ aspirations in video; the latter must react quickly and be able to move at Web speed to counter this challenge”.

The data in this release is taken from CCS Insight’s recently published Telecom Operator Multiplay Forecast, UK, 2015-2019.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally