SVOD becomes dominant U.S. model for accessing TV online

Wednesday, May 4th, 2016

New Data: Unprecedented Numbers of TV Consumers Flock to Netflix, Hulu and Amazon

- New study from Hub Entertainment Research shows a 20-point increase in proportion of consumers with an online TV subscription

BOSTON, MA — Over the past few years, predicting the future of television has involved more questions than answers. But new data from Hub’s annual “What’s TV Worth” study suggests we’re close to an answer to at least one critical question: How will tomorrow’s TV viewers want their content delivered?

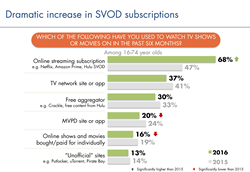

Several findings from the study demonstrate that the streaming subscription has become the dominant model for accessing TV online, clearly outpacing ad-supported aggregators (e.g., watching shows for free on Hulu), TV Everywhere (watching on TV network or provider apps), and transactional services (like iTunes).

- Substantial jump in SVOD subscribers: In 2015, 47% subscribed to an online streaming service. That number is now 68%, up 21 points in just one year.

- Strong growth for all SVOD platforms: Netflix is still the dominant player, with by far the most subscribers, and up significantly from last year. But Amazon and Hulu are growing even faster (up 59% and 60% from last year, respectively).

- Greater use of multiple SVOD services: 37% of consumers have two or more SVOD subscriptions, double the percentage in 2015 (19%).

Consistent with this general increase in SVOD subscription, Netflix in particular is now considered an even stronger value than services that allow consumers to watch TV content for free.

- Netflix’s value perception is high: 67% of all TV consumers say that Netflix offers excellent or good value as a service.

- Even the free version of Hulu doesn’t match up: 61% of consumers consider watching shows on the free, ad-supported version of Hulu to be an excellent or good value, 6 points behind Netflix.

“Consumers have accepted the idea that online TV services are worth paying for on a monthly basis,” said Peter Fondulas, principal at Hub Research and one of the authors of the study. “These findings show that subscription services like Netflix and Amazon are attracting more and more viewers with a combination of attractive features: deep catalog, growing numbers of original series, an intuitive interface, and a transparent log-in process.”

“Many in the industry have said that the appetite for TV content is enough to support lots of providers, and these findings suggest that they’re correct,” said Jon Giegengack from Hub. “The ‘all you can eat’ model of SVOD platforms is emerging as a clear favorite. And the fact that most SVOD subscribers use more than one SVOD platform is a telling development.”

About this Research

“2016: What’s TV Worth” is an annual tracking study among 1,502 US consumers with broadband, who watch at least 5 hours of TV per week. Hub has conducted this study since 2013. An excerpt and infographic of the report are available as a free download from Hub Entertainment Research. The current wave of the study was conducted in April 2016.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally