Hulu and Amazon SVOD almost always used in conjunction with Netflix

Tuesday, July 12th, 2016

New Data: Hulu and Amazon Streaming Subscriptions Almost Always Used in Conjunction with Netflix

- New study from Hub Entertainment Research shows that 83% of Amazon users, and 93% of Hulu users, also use Netflix.

BOSTON, MA — Online TV content comes in many shapes and sizes—free with ads, TV Everywhere linked to traditional MVPDs, transactional platforms to rent or buy video, etc. But a new study from Hub gives more evidence that consumer demand is converging around one model: subscription on demand.

Two thirds (66%) of TV viewers with broadband subscribe to at least one SVOD. That includes 64% of those with a traditional pay TV package

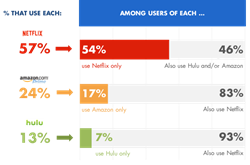

Netflix accounts for the lion’s share of SVOD accounts. 57% of viewers with broadband subscribe to Netflix, 24% watch content from Amazon Prime, and 13% subscribe to either the limited commercials or ad-free forms of Hulu.

Amazon Prime and Hulu viewers almost always have Netflix, too. 83% of Amazon Prime users, and 93% of Hulu users, also use Netflix.

As consumers adopt more SVODs, Netflix may face more competition for disposable TV time. Viewers who subscribe to Netflix alone spend about a third (32%) of their total TV time watching Netflix. But those who subscribe to Netflix and Hulu only spend a quarter (24%) of their total viewing on Netflix.

“Netflix introduced consumers to “all you can eat” subscriptions, and successfully sold them on a new model to discover, consume and pay for content. As Hulu and Amazon invest more in content and original programming, many viewers see value in multiple subscriptions with the same model,” said Jon Giegengack, Principal at Hub.

“Once the upstart challenging pay TV’s dominance, Netflix now finds itself as the Goliath of SVOD,” said Peter Fondulas, Principal at Hub. “Netflix doesn’t seem to run much risk of being replaced—viewers are adopting other SVODs in greater numbers, but to supplement Netflix not replace it. But where there will be more competition is to be the first stop on the virtual dial, as consumers’ finite TV time is allocated across more alternatives.”

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally