Western Europe pay-TV successfully fighting off the OTT challenge

Wednesday, October 5th, 2016

No Brexit For Netflix – Pay-TV and Netflix work in harmony in Europe

New research from Ovum shows that Western Europe’s pay-TV markets continue to grow, successfully fighting off the challenge posed by OTT video and the region’s free-to-air TV offerings. There were 98m pay-TV subscribers in Western Europe at mid-2016 and Ovum is forecasting that seven million more will be added by the end of 2021, taking the total to 105 million. The 100m subscriber barrier will be reached next year.

According to Adam Steel, Ovum’s TV Analyst specializing in Western European markets: “Western European pay-TV operators have invested in new technologies to create an impressively sophisticated operating environment. Value added services like bundled VOD catalogues, DVRs and HD are keeping existing clients happy enough to retain the service but also, crucially, they are still attracting new subscribers too. Great content remains critical to success, but that must be supplemented by customer experiences which offer significant differentiation from those offered by lower cost, in particular OTT, alternatives.”

Tony Gunnarsson, senior TV analyst at Ovum, added: “No-one should underestimate the challenge posed by Netflix and other OTT services. But our research shows that Netflix’s growth is slowing in mature SVOD markets such as the UK and Scandinavia, indicating that after an initial growth spurt in each market its rate of progress begins to decelerate. Crucially, Ovum also finds that SVOD subscribers are overwhelmingly pay TV subscribers in many markets: SVOD and pay TV are not “either” “or” propositions. Audiences are increasingly using both.”

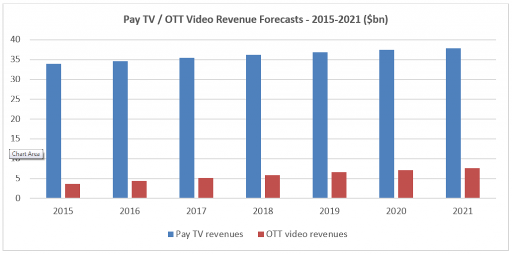

Ovum’s new research – Western Europe: Pay-TV & Free-To-Air Forecasts to 2021 – also shows that during the 2015 to 2021 period pay-TV revenues will grow by almost 12%, rising from US$33.9bn to US$37.9bn. During the same period, digital TV household numbers will increase from 159m to 180m, meaning digital TV penetration will rise from 91% of TV households to 99%.

Adam Thomas, Ovum’s Lead Analyst for Global TV Markets, noted: “The completion of switchover from analog terrestrial to digital is now complete and this has further intensified the pressure on pay-TV. With digital terrestrial TV offering around 50 channels, usually for free, pay-TV platforms have had to up their game to convince subscribers that their service is demonstrably better than the free offerings. Our new research indicates that those conversations with their clients are generally proving successful.”

Thomas added: “Ovum’s belief is that pay-TV is increasingly reacting credibly to not just the OTT threat but also in realising the opportunities offered by online distribution. Pay-TV content is widely available on a range of connectable devices. Consumer demand for more flexible viewing options is being addressed by streaming services with linear TV, so enhancing the extensive on-demand offerings already available. All of this indicates a positive outlook for European pay-TV as we head towards 2017.”

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally