U.S. subscriber declines spreading from voice to TV, broadband

Tuesday, December 6th, 2016

Triple cord-cutting bites for US service providers

- Ovum finds subscriber declines spreading from fixed voice to TV, broadband

Ovum has released its 3Q16 subscriber growth figures for fixed voice, fixed broadband, and pay TV for the US, as captured in Ovum’s World Broadband Information Service (WBIS). Ovum notes that a triple cord-cutting threat – the loss of subscribers in all three core fixed services – continues to loom over the US.

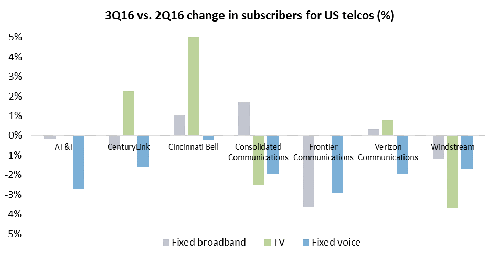

- In 3Q16, among the largest US telcos, AT&T and Windstream continued to see declines in all three services, while Frontier posted a decline in the two services it does offer. CenturyLink and Consolidated Communications are at risk, with declines in two out of three services. Verizon, which recently shed properties in a number of markets to Frontier, also fits in the at-risk category with a couple of quarters of decline in fixed broadband – in 2Q15 and 1Q16 – and very low pay-TV subscriber growth.

- Most US telcos have been losing fixed voice subscribers for years, but are now confronted with subscriber losses in either pay TV or fixed broadband, or both.

- Cincinnati Bell and CenturyLink were bright spots in pay TV, with both registering growth in 3Q16, but off of rather small subscriber bases, and in the case of CenturyLink, a much smaller base of subscribers compared to its broadband segment.

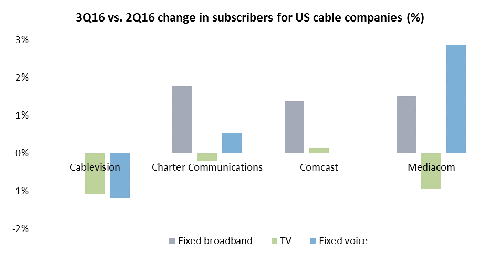

- With the exception of Cablevision, which was recently acquired by Altice, cable companies fared better, with Charter, Comcast, and Mediacom all posting growth in fixed broadband and fixed voice. However, Charter and Mediacom continue to lose pay-TV subscribers and Comcast recently started to show a growth trend. Cablevision falls into the triple cord-cutting category, with declines in pay TV and fixed voice and no growth in fixed broadband.

- Triple cord-cutting does mask growth in next-generation broadband and shifts to more cost-efficient platforms (such as AT&T continuing to deploy FTTP in multiple cities and moving from U-verse to DirecTV for its pay-TV platform). In addition, some operators are being more selective, in terms of credit worthiness, in targeting customers, citing that as a reason for their subscriber declines.

Source: Ovum WBIS

Source: Ovum WBIS

“Cord-cutting started in landlines and gave way to cord-cutting in pay TV in the US. We are now entering the realm of triple cord-cutting. This is the reason why US service providers are diversifying their business away from their core services towards the path of becoming digital service providers. This is also the reason why M&A is likely to continue in the US market.” Kristin Paulin, Senior Analyst

“The decline of subscribers in telco core services is by no means a US-only trend. Fixed voice subscribers are declining in multiple countries tracked by Ovum worldwide. Fixed broadband and pay-TV declines are also beginning to make an appearance.” Kamalini Ganguly, Senior Analyst

Triple cord-cutting represents a shift in communications services, and service providers need to chart new service, bundling, and pricing strategies. It presents an opportunity for telcos and cable companies to explore new types of services – such as own-OTT video services and via partnerships, which Ovum tracks. Own-OTT video services are sometimes bundled with the core fixed broadband service, allowing service providers to retain some core services while introducing new revenue streams. However, the triple cord-cutting trend also shows why it is important to have a relationship with mobile – whether owned or as an MVNO – for future services. Ovum is tracking new types of bundles with mobile broadband.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally