Quarter of European OTT platforms export outside country of origin

Wednesday, November 15th, 2017

Have VOD, will travel: TVT Media research shows a quarter of European OTT platforms export on-demand outside country of origin

- UK driving the on-demand revolution in Europe as home to more than 200 over-the-top (OTT) video on demand (VOD) platforms – including 82 targeted outside the UK

- Netherlands emerging as rival hub, with 18 platforms aimed beyond its borders

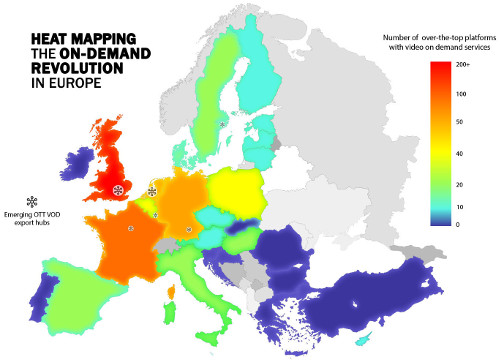

- The second in TVT’s European Media Map series identifies OTT VOD hotspots across the EU and Turkey

LONDON — Research from TVT Media, the new global content services powerhouse, shows the UK is at the epicentre of the explosion in over-the-top (OTT) video on demand (VOD) services across the European Union and Turkey, as 82 of its 226 OTT platforms – double any other EU nation – are VOD services targeted outside the UK. The research, commissioned by TVT Media and conducted by Media Asset Capital, also reveals that the Netherlands is rising fast as the second major OTT VOD export centre, with Luxembourg, France, Sweden and Germany also strongly supporting cross-border digital TV services.

In the second part of its European Media Maps series, TVT was able to map OTT VOD hotspots across Europe, based on its comprehensive database of OTT platforms such as BBC iPlayer, Netflix, Amazon Prime, Discovery Channel (catch-up) and Dreamworks’ AwesomenessTV. The map also reveals which nations are emerging as major pan-European OTT VOD hubs, as the research shows close to a quarter (23%) of OTT platforms (153 out or 673) are VOD services targeted outside their country of origin.

Ian Brotherston, Chief Executive of TVT Media, comments: “The research highlights the fact that Europe’s growing number of multi-device, multiscreen, multiservice consumers want more on-demand content, along with new ways to access it – and that the industry is responding well to these demands. It is also very clear that OTT is the driver behind VOD growth, but its development is still closely tied to high-speed broadband availability and the infrastructure of pioneering internet markets – reflected by the fact the UK and Netherlands have proven so adept at attracting OTT service providers.”

Brotherston adds: “What is evident is that OTT is a major disruptive force that is changing the way service providers view their operations. The need to be physically located in a particular country is no longer a fundamental requirement. The internet has released content from geographic constraints and the future is likely to see more broadcasters, studios and other content owners following the model of leading innovators by delivering services via multinational platforms.”

The research demonstrates that the UK, and London in particular, has solidified its position as a global media centre with its emergence as the leading European OTT hub, with 215 specific VOD services – close to 40% targeted abroad. Amazon Instant Video and parts of the Sony group, both have more than 30 UK-based OTT VOD services going to mainland Europe through a single licensed platform each – counting as just two of the 82 UK exporting platforms. Similarly, Discovery Communications Europe, Modern Times Group, Walt Disney Company and Playboy TV all have over 10 OTT services targeting various EU countries but originating from a single platform in the UK.

Perhaps the biggest revelation from the research is that the Netherlands – with Amsterdam leading the way – is beginning to rival the UK as the main European OTT VOD export hub. Although the Netherlands is nominally listed as home to 51 OTT platforms, with 18 targeting external markets, this figure includes the European base for Netflix, which serves as a hub for 37 separate platforms across the region. In addition, the Netherlands is home to Modern Times Group’s ‘Zoom’ OTT services, which target 17 countries across Europe, and a regional centre for Liberty Global Services’ UPC and Virgin Media brands. These platforms are registered as single entities, yet if each of the constituent services were counted individually, the Netherlands would approach the UK as the largest exporter of OTT with more than 70 platforms.

Key findings on the OTT VOD market across Europe also include:

- France has the second most OTT platforms with 115, but just 10 serving other EU countries – mainly French speaking areas in the Benelux and Alps regions; but it also has 11 French/Arabic VOD services targeting former colonies in North Africa

- Luxembourg is a disproportionately large VOD exporter – 20 OTT platforms, with 13 aimed at other countries, mainly due to its position as the headquarters of major pan-European broadcaster RTL

- Only six of Germany’s 52 OTT Platforms are aimed outside its borders – exporting primarily to German-speaking populations in neighbouring nations, with Austria the main OTT VOD service destination

- A third of Sweden’s 21 OTT platforms target external markets – mainly the rest of the Nordic region and other northern European markets

- Ireland only boasts a single OTT platform that targets other European territories – but this is Apple’s iTunes VOD service, making the country one of Europe’s largest exporters in terms of users reached

- The North-South divide – the nine nations that don’t host any home-grown on-demand platforms are all in the southern half of Europe, in countries where broadband infrastructure lags behind that in much of northern Europe

The European Media Map series highlights critical information on broadcast languages, content genres, video on demand services, online platforms and other elements of the TV market in all 28 EU countries and Turkey, which have a population footprint of 600 million. The series grew out of the capture of in-depth data on licensed broadcasters and video platforms across Europe, commissioned by TVT Media and compiled by Media Asset Capital – with the aim of building an unrivalled understanding of on-going developments in the European broadcast and on-demand media market.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally