Exodus from pay TV in the U.S. accelerates despite OTT partnerships

Tuesday, July 24th, 2018Exodus from Pay TV Accelerates Despite OTT Partnerships

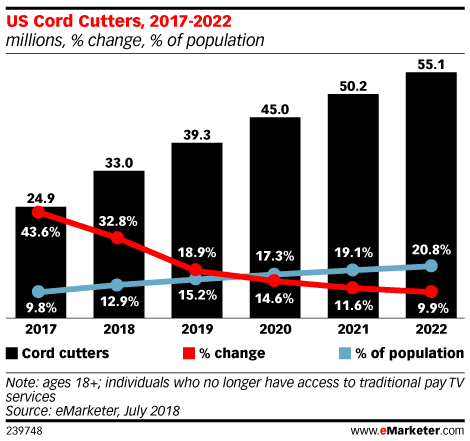

- Cord-cutters to jump more than 30% this year

Even as traditional pay TV providers form partnerships with former over-the-top (OTT) rivals to retain customers, cord-cutting continues to outpace projections. According to eMarketer’s latest US pay TV/OTT forecast, the number of cord-cutters (adults who’ve ever cancelled pay TV service and continue without it) will climb 32.8% this year to 33.0 million. That’s higher than the 22.0% growth rate (27.1 million) projected in July 2017.

Overall, 186.7 million US adults will watch pay TV (cable, satellite or telco) in 2018, down 3.8% over last year. That’s slightly higher than the 3.4% dip in 2017. Satellite providers will have the biggest decline, followed by telco.

“Most of the major traditional TV providers [Charter, Comcast, Dish, etc.] now have some way to integrate with Netflix,” eMarketer senior forecasting analyst Christopher Bendtsen said. “These partnerships are still in the early stages, so we don’t foresee them having a significant impact reducing churn this year. With more pay TV and OTT partnerships expected in the future, combined with other strategies, providers could eventually slow—but not stop—the losses.”

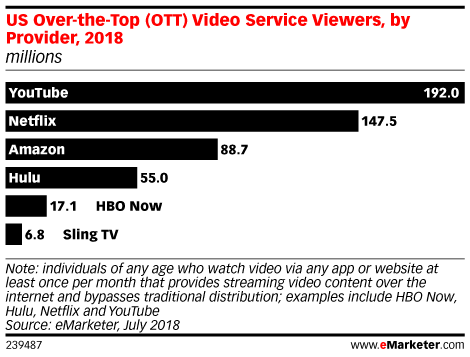

Meanwhile, the streaming platforms are growing at the expense of pay TV losses. In fact, eMarketer has increased its future viewership estimates for YouTube, Netflix, Amazon and Hulu. Growth is being fueled by more original programming and demand for multiple services.

“The main factor fueling growth of on-demand streaming platforms is their original content,” eMarketer principal analyst Paul Verna said. “Consumers increasingly choose services on the strength of the programming they offer, and the platforms are stepping up with billions in spending on premium shows. Another factor driving the acceleration of cord-cutting is the availability of compelling and affordable live TV packages that are delivered via the internet without the need for installation fees or hardware.”

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally