SVOD feeds Australian's insatiable appetite for streaming content

Monday, July 30th, 2018

Video streaming growing strongly as consumers tap into multiple services

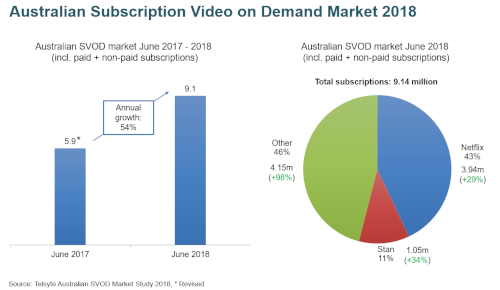

SYDNEY, Australia — The Australian Subscription Video on Demand (SVOD) services market continues to grow strongly reaching 9.1 million subscriptions at the end of June 2018, a year-on-year increase of 54 per cent, according to new research from emerging technology analyst firm Telsyte.

Over the same period, SVOD revenues in Australia grew substantially (up 90 per cent) reaching over $700m at the end of the 2018 financial year.

Telsyte forecasts Australians will hold more than twice as many SVOD subscriptions (22 million) by the end of June 2022.

Streaming entertainment – delivered to Internet connected devices such as smartphones, set top boxes, games consoles and smart TVs – is quickly becoming the mainstream way consumers view video content.

In total, Telsyte estimates 43 per cent of Australian households subscribed to SVOD services at the end of June 2018, an increase from around 30 per cent a year ago. This compares to around 70 per cent in the USA and 60 per cent in the UK, showing the growth opportunity within the next few years.

The market leader is Netflix with around 3.9 million subscriptions, with Stan in second place with a little over 1 million. However, new services (e.g. Amazon Prime, Foxtel Now), and a growing list of popular sports and special interests are collectively feeding Australian’s hunger for video content.

New SVOD services, including potentially those from Disney, HBO and various sporting codes, are expected to appeal to even more audiences.

Telsyte research shows Australians are increasingly comfortable with subscription-based entertainment services with millions turning to subscriptions for SVOD, music (e.g. Spotify, Apple Music), and game console subscriptions (e.g. PlayStation Plus, Xbox Live Gold).

The uptake of SVOD services is putting pressure on traditional pay TV, which is found in around one-third of Australian households (end of June 2018), a similar level to 2017. The growth of Fetch TV, that allows access to both SVOD and Pay TV content via its set top boxes, offset the decline in Foxtel subscriptions.

Telsyte Managing Director, Foad Fadaghi, says the SVOD market is not showing signs of being “winner takes all”. “Consumers are becoming comfortable with multiple subscriptions and are subscribing to different providers for exclusive content and live sports” Fadaghi says.

Sports a big winner for SVOD

Australians’ love for sports has been a big driver for SVOD, with sporting codes like AFL, NRL, and Netball (all exclusive to Telstra) showing strong demand, with usage exceeding the reported 1.5 million subscriptions in February 2018. Other popular niche services include UFC, NBA and MLB.

Despite the technical issues, Telsyte estimates more than 2 million Australians* watched the FIFA World Cup in June 2018 via Optus Sport.

Unlimited broadband and generous mobile caps underpinning SVOD consumption

SVOD services are big drivers for data consumption across fixed broadband and mobile networks.

“Average monthly data usage on mobile and fixed broadband by SVOD users are both over 45 per cent higher when compared to those that do not use SVOD” Telsyte Senior Analyst Alvin Lee says.

SVOD depends on broadband connectivity and as nbn and 5G wireless deployments continue, more Australians will be able to access streaming in 4K HDR quality, which is fast becoming standard on new smart TVs, and is increasingly supported on other digital devices.

Telsyte research found 1 in 6 Australians streamed movies or TV shows in 4K HDR in the last 12 months. Amongst 4K TV owners, 1 in 3 streamed 4K HDR content, demonstrating growing consumer appetite for higher video quality when available.

According to Telsyte, 4K TVs are already in some 15 per cent of Australian households and penetration will grow to around 50 per cent by 2022.

Broadcast VOD growth slowing

According to Telsyte, growth in uptake of catch up and live traditional TV streaming services – sometimes called Broadcast VOD (i.e. 7Plus, 9Now, tenplay, ABC iView, SBS On Demand.) has slowed down, with SVOD penetration on track to overtake it. Telsyte estimates there are currently 4.1 million households with SVOD services versus 5.2 million households with broadcast VOD.

However, BVOD and ad-free services in the case of ABC iView, continue to be an important channel for children’s content with more than 5.5 million children viewing these services, a 6 per cent year-on-year increase.

* Telsyte will not be releasing Optus Sport subscription estimates, the provided estimate is audience size based on survey data only

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally