TDG research shows sensitivity of Netflix subscribers to price rises

Wednesday, January 16th, 2019

TDG: New Research Reveals Growing Sensitivity among Netflix Subscribers to Price Increases

- Netflix’s Fee Increase Tests Not Only Subscriber Loyalty but Short-Term Price Ceilings for SVOD in General

New research from The Diffusion Group finds that, while subscriber reaction to Netflix’s recent price increase varies relative to degree, even minor variations may have significant implications. Case in point: at $1 more per month, 16% of Netflix subscribers are likely to either downgrade to a lower tier or cancel Netflix altogether — this according to TDG’s ninth iteration of Quantum Viewing Behavior, a survey of 1,940 US adult broadband users completed in December 2018.

Netflix announced on January 15 that it is raising the cost of its Basic tier by a dollar, from $8 to $9 a month. The Standard tier now costs $2 more per month, up from $11 to $13; same with the Premium tier, up from $14 to $16.

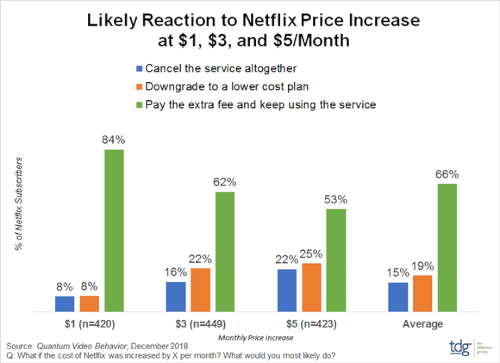

Anticipating an increase in 2019, in December 2018 TDG tested price sensitivity toward monthly Netflix cost increases. Top-line results are featured below.

Netflix subscribers were split into three exclusive groups, with each asked of their likely intentions should the cost of service increase by either $1, $3, or $5 per month. Each respondent answered for only one random price assignment.

As illustrated, at an increase of $1 per month, 8% of Netflix subscribers say they would downgrade their plan, with 8% saying they would cancel service altogether. (Basic subscribers were only offered two response options, as Basic is the lowest tier of service.) At an increase of $3 per month, the rate of likely cancellations doubled, while the rate of likely downgrades nearly tripled. At an increase of $5 per month, the rate of likely cancellation increased another six points (38%), while the rate of likely downgrade increased only three points (17%).

“While TDG believes that Netflix will endure any short-term backlash from these increases, it is undoubtedly reaching a level of price resistance across all tiers,” notes Michael Greeson, President of TDG. “At an average increase of $3 per month, 33% of Standard tier subscribers are likely (though not certain) to downgrade to a less expensive plan and 10% are likely to cancel the service altogether, compared with 28% and 6% of Premium tier subscribers, respectively. These variances are not insignificant.”

Greeson adds that other SVOD providers should pay close attention to these results, as they set a benchmark for the entire SVOD market space. “Netflix is the most highly valued SVOD service and enjoys the most loyal subscribers. As such, if it encounters resistance at these pricing levels, undoubtedly others will, as well.”

The new data is part of TDG’s annual Quantum Video Behavior study, which addresses video habits across a wide range of services (pay-TV, TVE, SVOD, TVOD, and AVOD) and devices (TVs, PCs, tablets, and smartphones).

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally