U.S. vMVPDs likely to gain subscribers from traditional pay TV

Thursday, January 28th, 2021

43% of US broadband households with traditional pay TV are likely to switch to a vMVPD in next 12 months

- Industry report examines the growth of vMVPD sector in the pay-TV market and future-facing challenges

DALLAS — Just released research from Parks Associates reveals 43% of US broadband households with traditional pay TV are likely to switch to a virtual multichannel video programming distributor (vMVPD) in the next 12 months. The research, found in Growth and Challenges for vMVPDs, shows that while the absence of live sports and live performances during the COVID-19 pandemic created challenges for vMVPDs, the successful services like Hulu + Live TV and YouTube TV have been able to push the advantages in pricing, content, and platform flexibility to drive growth. The report examines the growth of this sector in the pay-TV market, the strategies and outlook for market players, and the challenges ahead for vMVPDs and the pay-TV market as a whole.

“Subscriber losses in traditional pay TV continue, while the vMVPD category continues to grow, thanks to consumer price sensitivity and preferences for platform flexibility,” said Paul Erickson, Senior Analyst, Parks Associates. “Traditional pay-TV operators have online delivery in their roadmaps, if not already deployed. We expect vMVPDs will continue to grow dramatically and will gradually become the dominant offering in the pay-TV landscape.”

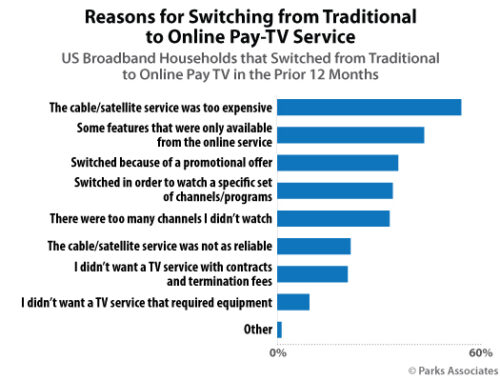

The report also reveals 17% of vMVPD subscribers switched from traditional pay TV within the last twelve months. The factors driving pay-TV defections include pricing and perceived value, while consumers positively respond to the flexibility of vMVPDs to deliver unique and targeted content packages on a variety of connected entertainment platforms.

Prior to the pandemic’s effects on streaming video consumption, vMVPD subscriber growth was waning, with some vMVPDs posting continued losses. Though COVID-19 has driven growth and in some cases recovery in the category, recent increases in vMVPD pricing make it uncertain how consumers will respond long term.

“vMVPDs have substantial opportunity if they can avoid the pitfalls that typically drive pay-TV customer dissatisfaction, such as rising prices and inflexible content and platform options. With content prices rising and competition increasing, vMVPDs should remain conscious of consumer price sensitivity while keeping a strict adherence to a consumer-centric experience,” Erickson said.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally