TV advertising in Asia Pacific declined 15% in 2020

Monday, June 14th, 2021

Net Advertising Spend In Asia Pacific Declined 4.3% Y/Y In Pandemic Year; Recovery Expected In 2021, With 7.6% Growth

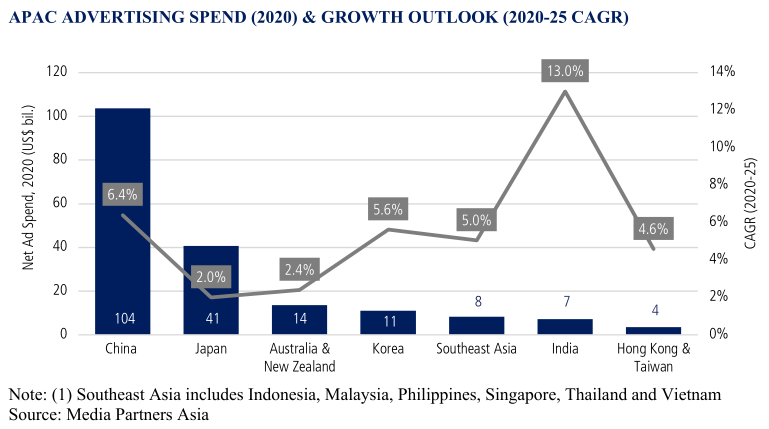

- Pandemic-induced uncertainty and advertiser pullback in 1H 2020 resulted in a 4.3% Y/Y decline in Asia Pacific net advertising expenditure to US$188 billion in 2020.

- Digital was the largest medium, contributing 59% of ad spend, followed by television (23%), out- of-home (9%), print (6%), radio (3%) and cinema (0.5%).

- Digital advertising proved most resilient to soft advertiser demand in 2020, netting growth in most markets. The medium is projected to grow to contribute 67% of APAC ad revenue in 2025, eating into TV’s share (18%).

- APAC advertising expenditure is forecast to grow at 5.4% CAGR to reach US$245 billion by 2025, powered by growth across key markets such as China, India, Japan, and Korea.

SINGAPORE — Net advertising expenditure in Asia Pacific, calculated after discounts, declined 4.3% Y/Y in 2020, according to a new report entitled Asia Pacific Advertising Trends 2021 from Media Partners Asia (MPA). Pandemic-induced macroeconomic uncertainty softened advertiser demand in 1H 2020. As economies rebound, recovery is underway with ad spend forecast to exceed US$200 billion by end 2021, topping pre-pandemic levels for the region largely due to China, which will account for 56% of total Asia Pacific advertising expenditure in 2021. Ad markets in Korea and Vietnam will also return to pre- pandemic net ad spend levels by end-2021. Most other countries will follow in 2022, bolstered by the growth of digital advertising; TV advertising will return to pre-pandemic levels in India, Thailand and Vietnam.

The Asia Pacific Advertising Trends 2021 report found digital ad revenue to be most resilient through the pandemic, with consumers across APAC spending more time online and brands accelerating digitalization efforts. The role of e-commerce in advertising surged in 2020, with e-commerce contributing an estimated 39% of China’s ad revenues, while growing significantly, albeit from a small base, in India, Indonesia, Japan and Korea. Search and social advertising benefited as well. MPA projects digital advertising’s share of net advertising spend to grow from 59% in 2020 to 67% in 2025.

TV advertising faced further pressure in 2020 as advertisers accelerated their transition to digital, declining 15% Y/Y to US$43.3 billion. In mature markets such as Australia and Japan, dips in TV ad spend are expected to be permanent, with a return to pre-pandemic spend unlikely. The medium remains important in key markets where it retains its position as the largest ad segment as of end-2020, including India, Indonesia, the Philippines and Thailand. Overall, TV advertising is expected to rebound in 2021, growing 4.6% Y/Y, before secular decline sets in again in 2023. MPA projects total Asia Pacific TV advertising spend to grow at CAGR of 0.7% over 2020-2025 to reach US$44.8 billion in 2025.

TV broadcasters are growing online video ad market share through catch up and dedicated AVOD streaming services, particularly in connected TV markets such as Australia, Japan and Korea. MPA estimates online video advertising, led by YouTube, contributed 16% to APAC digital ad revenue in 2020. With various local and regional AVOD and freemium platforms, including broadcaster-led platforms driving growth, online video advertising is forecast to grow to US$33.3 billion in 2025, representing 20% of the APAC digital ad pie while topping 40% in emerging markets such as India & Indonesia.

- China was the single largest contributor to advertising expenditure, with 55% share of APAC ad spend. China’s ad spend grew 0.5% Y/Y following strong recovery in 2H 2020, led by digital. Digital advertising, accounting for 70% of China’s total ad spend, grew a robust 8% Y/Y, anchored to short video, livestreaming, social, and e-commerce platforms.

- Following a 27% plunge in 2020, ad revenue in India is forecast to rebound strongly over 2020-25 with a CAGR of 13%. Digital advertising is expected to benefit from India’s expanding digital economy across online gaming, edtech, food and delivery platforms, outgrowing television to become the largest advertising segment by 2024.

- In Korea, ad spend fell 1% in 2020, with a 9% decline in television advertising bolstered by 12% growth in digital advertising, led by mobile, display and search ads. The Korean advertising market is forecast to grow at 6% CAGR over 2020-25. TV has bounced back strongly in Q1 2021 and digital advertising, including video, continues to maintain double digit growth levels.

- In large mature markets Japan and Australia, ad spend is projected to grow by 2% over 2020-25, led by digital. TV remains scalable in both markets with metropolitan FTA reach and engagement ensuring robust levels of share. Video’s share of digital advertising is growing in both markets with global tech majors dominant though broadcasters are growing rapidly from low base through dedicated streaming platforms.

- In Southeast Asia, ad markets across Indonesia, Philippines, Thailand and Vietnam are recovering rapidly with TV & online benefiting. Indonesia remains Southeast Asia’s largest advertising market and is projected to grow at 4% CAGR over 2020-25, powered by digital (including video) and free TV.

About This Report

Asia Pacific Advertising Trends, published annually by Media Partners Asia (MPA), contains detailed analysis of advertising media across 14 markets in Asia Pacific with a focus on TV and digital sectors. Key metrics include: (1) Historical and projected data (2015 to 2025); (2) Net advertising revenues across TV, internet (including online video), print (newspapers and magazines), out-of-home, radio and cinema; (3) Macroeconomic analysis and impact including GDP growth and currencies; and (4) Summary analysis / commentary by market.

Market coverage: Australia, China, Hong Kong, India, Indonesia, Japan, Korea, Malaysia, New Zealand, the Philippines, Singapore, Taiwan, Thailand and Vietnam.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally