MPA releases Asia Pacific Video & Broadband 2024 report

Wednesday, January 3rd, 2024

MPA Releases Asia Pacific Video & Broadband 2024 Report – Digital Continues To Drive Video Industry Growth

- New report released by Media Partners Asia (MPA) measures users, subscribers, consumer and advertising expenditure across free TV, pay-TV, SVOD, premium AVOD and UGC / Social Video in 14 markets with detailed historical and projected data.

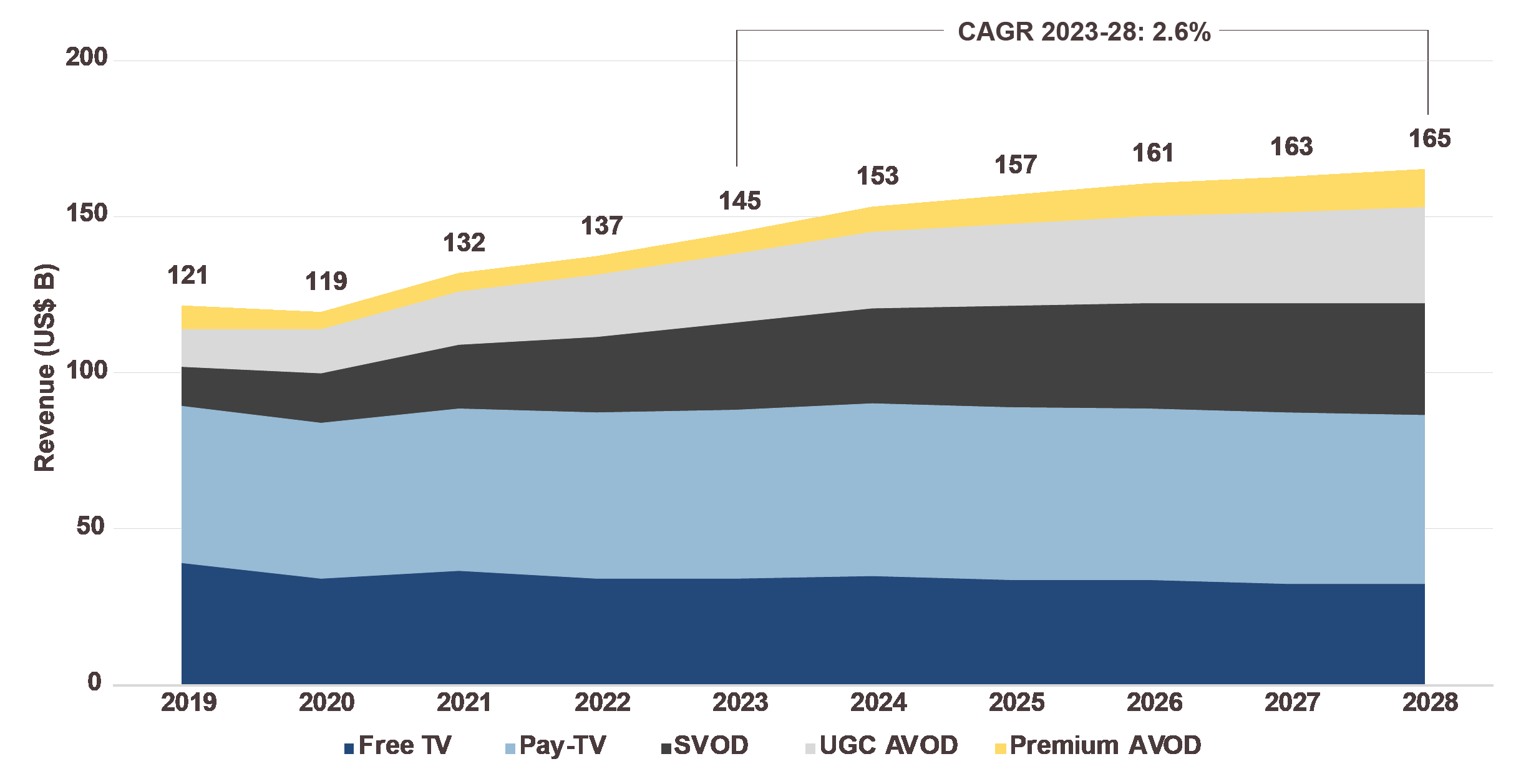

- APAC video industry grew by 5.5% in 2023 as total revenue reached US$145 billion. § 2023 performance driven by 13% growth in online video sector sales to US$57 billion, partially offset by less than 1% growth in the TV revenue pie to US$88 billion.

- China remains the largest and most regulated video market, generating US$64 billion in revenue in 2023. Ex-China, the largest markets in 2023 are Japan (US$32 billion), India (US$13 billion), Korea (US$12 billion) and Australia (US$9.5 billion) followed by Taiwan and Indonesia, both at around US$3 billion.

- MPA projections indicate that total APAC video industry revenues will grow at a CAGR of 2.6% between 2023-28 to reach US$165 billion by 2028 or at a CAGR of 3.3% ex-China to US$95 billion. The APAC online video sector is projected to grow at 6.7% CAGR to reach US$78.5 billion in value by 2028 or at 9.2% CAGR to US$46 bil. in APAC ex-China.

- Advertising contributed 51% to online video revenues in 2023. Advertising’s contribution is projected to grow to 54% by 2028 and to 63% in APAC ex-China (vs 58% in 2023).

- The six largest revenue generating video industry markets by 2028 will be: (1) China; (2) Japan; (3) India; (4) Korea; (5) Australia; and (6) Indonesia, with all contributing an aggregate >90% to the Asia Pacific total. The fastest growing markets over 2023-28 in terms of % CAGR will be Indonesia (7.3%), Philippines (6.2%), India (5.6%), Vietnam (4.6%) and Thailand (4.2%).

SINGAPORE — Media Partners Asia Research Services Pte Ltd (MPA) today announced the release of ASIA PACIFIC VIDEO & BROADBAND INDUSTRY 2024, a report providing a definitive guide to the adoption and monetization of free-to-air TV (free TV), pay-TV, SVOD, premium AVOD and UGC / Social Video advertising in 14 Asia Pacific markets.

Commenting on the findings of the report, MPA Managing & Executive Director Vivek Couto said: “The Asia Pacific video industry continues to experience a secular shift from TV to online in terms of engagement and monetization. Improved connectivity, rising connected TV (CTV) penetration combined with the growth of local creator economies, investment in premium local content as well as the wide availability of premium sports streaming, will continue to drive dollars and eyeballs online.

Clear beneficiaries in the digital video economy include global and local technology and media companies investing in product and content with consumers at the forefront of their strategies. According to MPA, 8 companies had an aggregate 65% share of the APAC online video revenue pie in 2023: Amazon Prime Video, ByteDance (including TikTok), Disney, Google-owned YouTube, iQIYI, Meta (video), Netflix and Tencent. Ex-China, certain local players are competing successfully and have scale potential, including Jio Cinema and Zee-Sony in India; Foxtel’s Kayo and Nine’s SVOD and BVOD platforms in Australia; TVer and U-Next in Japan; Tving in Korea; Vidio in Indonesia; and Viu across Southeast Asia.

New investments made by strategics and private equity in the online video sector in China, India, Indonesia, Japan, Korea and Southeast Asia are helping local and regional companies compete. The online video sector is also starting to rationalize with price increases in the SVOD category along with disciplined content and marketing investment, the introduction of ad tiers, new strategies to drive monetization and the start of local market consolidation in Korea, Japan and India.

Amidst the shift to online and the growth of CTV, traditional linear TV is under pressure with a number of territories not expected to see a meaningful return of TV ad dollars. Local broadcasters are capitalizing through premium AVOD and in certain cases, SVOD, most notably in Australia, India, Indonesia and Japan. Pay-TV subscription revenue has yet to be significantly disrupted by the growth of SVOD outside of markets such as Australia. However, historically strong markets such as India and Korea are under pressure while Malaysia, the strongest pay- TV market in Southeast Asia, is experiencing a deeper contraction across the traditional pay- TV segment, partially offset by the growth of bundled broadband and IPTV. In Indonesia and Thailand, the online VOD opportunity is increasingly more attractive than pay-TV.”

2023 in Numbers

The APAC video industry grew by 5.5% in 2023 as total revenue reached approximately US$145 billion, according to MPA estimates. The 2023 performance was driven by a 13% growth in online video sector sales to US$57 billion, partially offset by less than 1% growth in the TV revenue pie to US$88 billion. Excluding China, the APAC video industry grew by 3.2% in 2023 with revenue reaching US$81 billion, driven by a 13% increase in online video sales to US$30 billion while TV declined by 2% to US$51 billion. China remains the largest and most regulated video market in APAC, generating US$64 billion in revenue in 2023. Ex-China, the largest markets in 2023 were Japan (US$32 billion), India (US$13 billion), Korea (US$12 billion) and Australia (US$9.5 billion) followed by Taiwan and Indonesia, both moving towards US$3 billion.

Online SVOD grew 15% in 2023 to reach US$28 billion or 12% ex-China to US$12 billion while the AVOD pie grew 11% to US$29 billion or 13% ex-China to US$17 billion. UGC / social video continues to dominate the AVOD category with 80% share while premium AVOD had 20% share in 2023. Pay-TV subscription fees showed marginally below flat growth in APAC ex-China with revenue declines in important markets such as India and Japan while almost every market in Southeast Asia contracted. Pay-TV advertising grew in India but was decimated in Korea. Free TV advertising was down 2% in 2023 across APAC ex-China with significant declines in Australia, Indonesia and Korea.

Industry Forecasts

MPA projections indicate that total APAC video industry revenues will grow at a CAGR of 2.6% between 2023-28 to top US$165 billion by 2028 or at a CAGR of 3.3% ex-China to top US$95 billion. China will be increasingly mature and grow at 1.7% to reach US$70 billion by 2028, followed by Japan (US$35 billion), India (US$17 billion), Korea (US$14 billion), Australia (US$11 billion) and Indonesia (close to US$4 billion).

The APAC online video sector is projected to grow at 6.7% CAGR to reach US$78.5 billion in value by 2028 or 9.2% ex-China to reach US$46 billion by 2028. TV industry revenues, including advertising and subscription, will marginally contract at -0.4% CAGR between 2023-28 to reach US$86.5 billion by 2028 or at -1% CAGR to US$49 billion ex-China. Scaled TV markets that are expected to still grow but at a much smaller pace include India, Japan, Korea and Indonesia. There remain significant downside risks on TV advertising in Indonesia, India and Korea.

ASIA PACIFIC VIDEO INDUSTRY REVENUE BY CATEGORY

Notes:

Free TV (FTA) consists solely of advertising.

Pay-TV includes subscription & advertising revenue.

SVOD includes D2C & wholesale subscription revenue.

UGC & Premium AVOD solely consist of advertising revenue.

Source: Media Partners Asia

Links: Media Partners Asia

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally