AudienceXpress reveals UK findings from streaming video consumer study

Tuesday, April 4th, 2023

UK connected TV audiences continue to invest time in premium content, while viewing habits drive linear and digital convergence — according to latest study from FreeWheel’s AudienceXpress and consumer research specialist Happydemics

- AudienceXpress, FreeWheel’s premium video media sales house reveals the UK findings from the third iteration of its Streaming Video: CTV Uncovered 2023 consumer study, which delves into Connected TV (CTV) users’ viewing preferences and opinions

Key findings

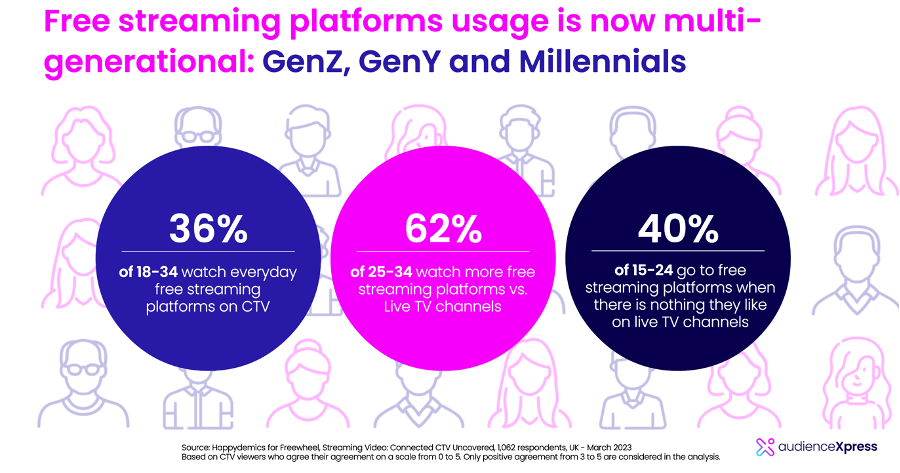

- 46% of UK CTV viewers surveyed who access free video streaming platforms watch content on these platforms every day.

- CTV audiences in the UK regularly tune in to a broad mix of platforms, with subscription-based video-on-demand (SVOD) being the first choice for 55% of Brits, followed by Live TV channels (37%) and TV replay (35%).

- In comparison to other countries, UK-based respondents are tuning in the most to broadcaster video-on-demand content (BVOD). Along with their huge consumption of SVOD content, this trend confirms UK viewers are fully behind streaming platforms as a whole, and that there’s still interest in what broadcasters have to offer.

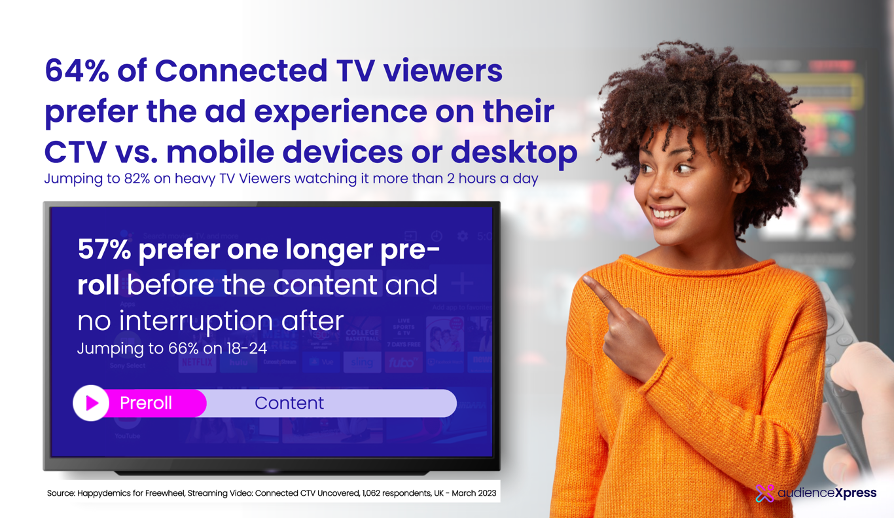

- When it comes to the advertising experience, nearly six in ten UK CTV viewers surveyed prefer a long ad break at the start of the content only, while a third want to see contextual advertising.

LONDON — AudienceXpress, FreeWheel’s premium video media sales house, today announces the findings from the third iteration of its Streaming Video: CTV Uncovered 2023 consumer study, conducted in collaboration with independent research specialist, Happydemics. The research explores viewers’ uptake of CTV and their views on the TV advertising experience, alongside their preferences and perceptions of different channels and platforms. The study was conducted in the UK, Italy, France, Germany, Spain, and the Netherlands – collectively known as the EU6.

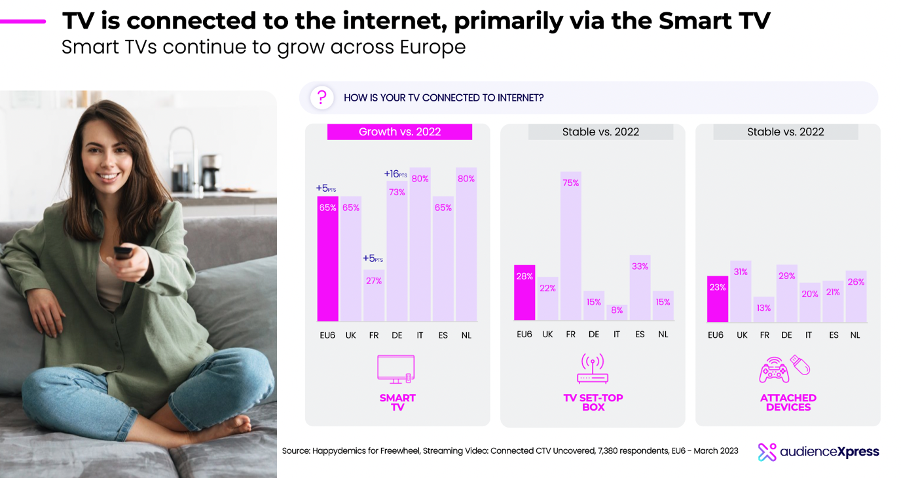

Connected TV continues to rise in popularity

With 65% of European viewers who have now connected their TV to the internet, directly through Smart TVs, representing an increase of five points YOY, Smart TVs are the only connectivity device type rising across Europe. While broadcast TV content remains a dominant platform, over 51% of EU6 respondents who use CTV and watch free on-demand streaming content shared that they watch these more than live TV; this trend was particularly notable among survey participants aged 15 to 34. Further, almost a half of European respondents who tune in to free streaming services on their CTV screen (43%) do so every day. Connected TV is now taking centre stage for consumers; allowing them to access a wide array of platforms and services, jumping around from one to another to view their favourite entertainment.

UK audiences are now natural born streamers

Regarding overall consumption habits, 55% of the UK CTV viewers surveyed claimed to use CTV to access subscription-based video-on-demand (SVOD), followed by 37% who tune in to broadcasters’ live TV, and 35% who watch broadcaster video-on-demand (BVOD) channels on CTV. Broadcast TV remains king overall, though evidently, the UK CTV audiences are accessing TV-like content through a diverse mix of channels and platforms.

Interestingly, more than half of those who access content via free on-demand streaming services on CTV (59%) do so when they cannot find programmes they enjoy on linear TV channels. Users are still very attracted to what makes TV unique: free and professionally-produced content. Streaming and linear content are not rivals but complementary to each other.

Context, timing, and volume: the key factors of a strong advertising experience

Data remains a sensitive issue, and with the end of third-party cookies nearing, there are reasons to accelerate and regain consumer trust and ensure that their privacy is at the core of industry concerns. According to the study, almost a third (32%) of UK CTV viewers have a preference for contextual ads that are informed by the content they are watching. This percentage goes up to 42% among the 25-34 age group. Moreover, 57% of UK CTV respondents favour one longer ad break before the content and no ads afterwards; this was especially the case for respondents aged 18 to 24 years old.

71% of UK survey respondents who access content through social video aggregators on CTV feel there are too many ads on these platforms. Consequently, UK CTV viewers say they recall ads viewed on CTV screens better than ads they are exposed to on video aggregators. Improving the ad experience will help to better capture consumers’ attention. The creative will still play a big part in advertising efficiency, as well as the format and repetition, but there is also a question of adjusting to suit consumer preferences.

“Evolving viewing habits are continuing to drive the convergence of digital and linear TV, with premium video content from online video aggregators now being watched on the TV screen,” said Stefanie Briec, Director, Head of Demand Sales UK & International for AudienceXpress. “Alongside this, the increase of hybrid streaming services on the market, which include both AVOD (ad-supported video-on-demand) and SVOD in their business models, underscores the reality that high quality, TV-like content retains the power to capture audience attention regardless of channel or platform. Moving forward, marketers require a holistic approach to TV to identify the channels that complement each other and boost the performance of their campaigns.”

Methodology

FreeWheel conducted a survey to uncover preferences and opinions from more than 7,380 connected consumers in Europe. The answers were collected online by consumer research specialist Happydemics between 31 January and 6 February 2023, forming part of a nationally representative study that included the UK, France, Germany, Spain, the Netherlands and Italy – collectively known as the EU6.

Links: FreeWheel; AudienceXpress

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally