Software and services drive U.S. consumer technology market growth

Wednesday, April 12th, 2023

Software and Services Drive Growth in U.S. Consumer Technology Market

- Streaming, subscriptions integral to how people use, experience consumer technology

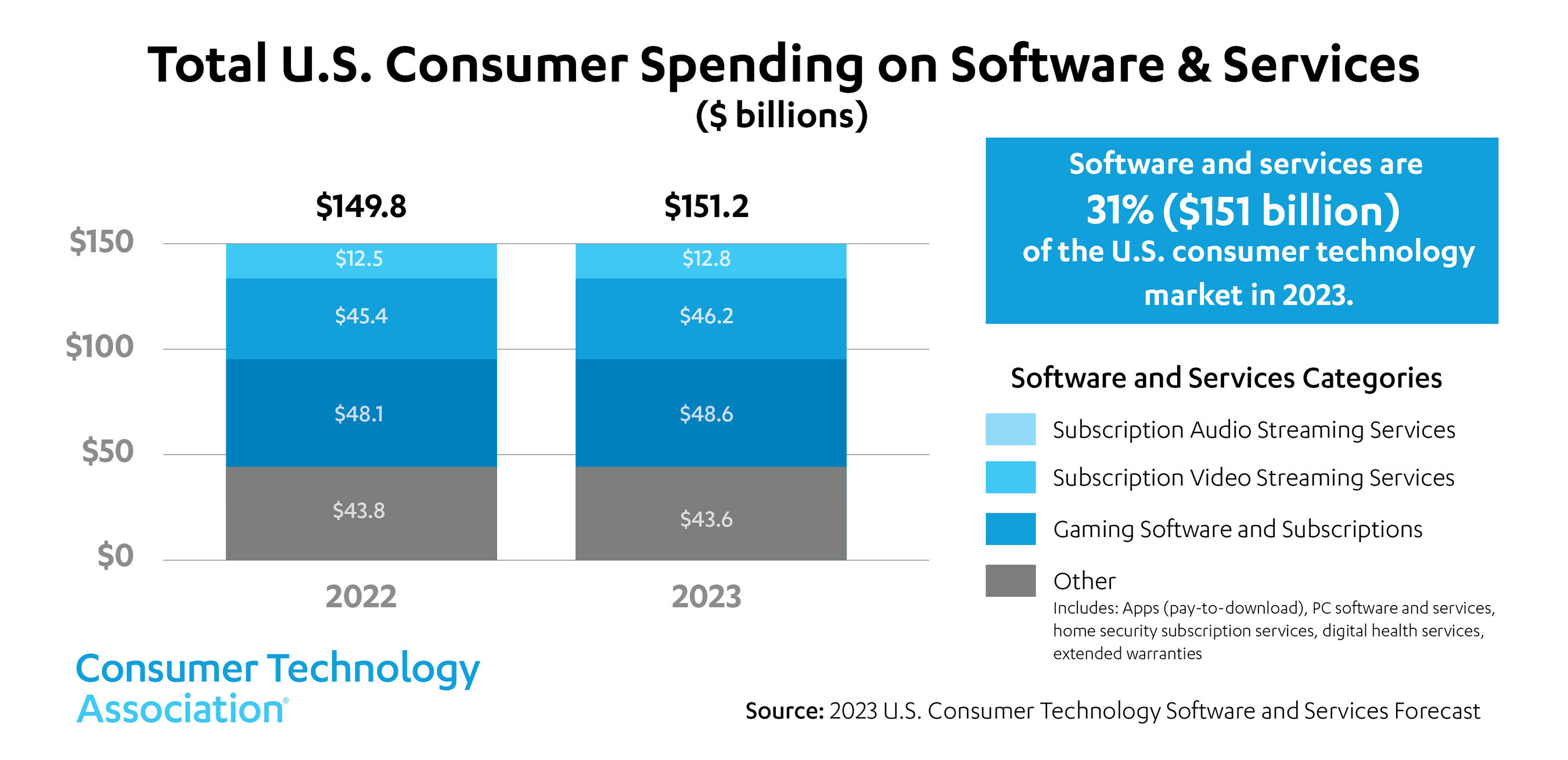

ARLINGTON, Va. — The Consumer Technology Association (CTA)® announced its first U.S. Consumer Technology Software and Services Industry Forecast today. The report shows that software and services account for 31% ($151 billion) of the U.S. consumer technology market in 2023. The sector’s rise is driven by a broadening portfolio of subscription services including new offerings like Digital Therapeutics (DTx). It finds consumers want a seamless experience when using different services, and service providers will continue to merge.

Based on CTA’s U.S. Consumer Technology One-Year Industry Forecast, this report reveals how software and services are evolving traditional views of how content is consumed. It previews how AI, IoT, cloud services and connectivity create new possibilities as designers leverage new tools to deliver compelling products. The category will contribute $1 billion in new spending to the industry this year, balancing flat demand for hardware.

“The rise of digital therapeutics, gaming and streaming offerings add vibrancy and choice to the consumer technology industry, offering entertainment on the go and the ability to manage your health,” said Rick Kowalski, Sr. Director, Business Intelligence at CTA. “Hardware remains important, but services are an essential part of the customer experience. They are expanding the possibilities of what we can do with our devices and shaping the future of entertainment.”

Top five software and service growth areas (2023 versus 2022):

- Digital Therapeutics (19% growth): Topping the growth list, DTx is a promising approach to health care that can improve patient outcomes and reduce health care costs. This emerging ($300 million) market has vast growth potential, with the sector up 25% in 2022 and predicting 19% growth in 2023. DTx helps address behavioral and mental health conditions such as attention deficit disorder, substance abuse recovery and post-traumatic stress disorder.

- Gaming subscription services (10% growth): Competition is intensifying as gamers embrace cloud gaming, subscription services offer more games, and video streaming services enter the fray to compete with console manufacturers.

- Fitness subscription services (5% growth): Consumers flocked to connected fitness equipment during the pandemic and discovered the ease, simplicity and benefits of working out at home. As consumers seek more value and convenience, this industry will see fierce competition among incumbents, and disruptors offering a variety of workouts and access to entertaining trainers will fare better than most.

- Live TV streaming (4% growth): 2022 marked the start of a new era of subscription video-on-demand (SVOD) as costs and churn increased across the streaming video space. Streaming providers have seen subscriber growth thanks to ad-supported VOD (AVOD) offerings. Over-the-top (OTT) and SVOD are likely to unify as traditional SVOD players look to consolidate or bundle offerings, adding sports and live programming to draw subscribers.

- Home security subscription services (4% growth): Security products are among the most desired for those who plan to purchase smart home tech in the coming year.

Key Influences on Services Spending

Economic uncertainty is weighing on consumers and businesses. Inflation, rising debt and dwindling savings are the biggest concerns influencing consumer spending:

- Gaming remains the largest form of digital entertainment. But, for the first time since forecasting the gaming software category, CTA estimates U.S. gaming software revenues contracted by 6% in 2022, to $48.1 billion.

- Fewer discretionary dollars. Higher prices on necessities compete with available dollars for services.

- Higher prices on services. Many services have increased monthly fees, especially streaming video services.

- Consumer uncertainty persists. Consumers may have a tough time making decisions because they don’t know what will happen to the economy.

- Subscription fatigue. With so many services available, consumers may look to save money by bundling or reducing the number of services they use.

- Disruption continues. Streaming services continue to shake up long-standing business models.

Methodology

Twice each year since 1967, the CTA updates its forecast of more than 125 consumer technology products and services. This forecast serves as the benchmark for the consumer technology industry, charting the size and growth of underlying categories and the industry. It is used by manufacturers and retailers for creating product development plans; financial analysts for sizing market opportunities; industry and general media for providing context in their coverage; government staff for understanding the scope of the industry to guide policy decisions; and CTA itself for highlighting the successes and challenges of the industry.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally