MPA releases India online video report 2022-23

Wednesday, May 17th, 2023

MPA Releases India Online Video Report 2022-23

- Premium VOD viewership share at 12%; You Tube at 88%.

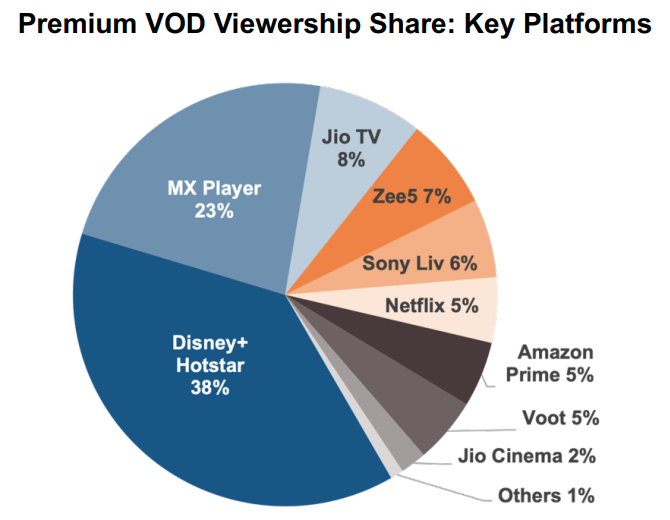

- Disney+ Hotstar led premium VOD category viewership over CY 2022 / Q1 2023 with 38% share.

- Jio Cinema rises in April 2023 on the back of free IPL cricket live stream.

- Local content dominates premium VOD viewership ex-sports.

- Paid tier viewership led by international content at 51% ex-sports with local content contributing 49%.

MUMBAI — A detailed report published today by Media Partners Asia (MPA), leveraging data from its consumer insights and measurement arm AMPD, provides deep dive insights on the growing online video industry in India over the calendar year 2022 and Q1 2023.

The report, entitled ‘India Online Video Report: Analysis of Consumption, Content & Investment Trends’, leverages data from the AMPD platform owned and operated by MPA. The AMPD platform uses a permission-based panel of consumers who consent to the collection of their session-based activity. For the report, the platform passively measured real consumption on Android and iOS mobile and computer devices in India in across calendar year or CY 2022 and the three months to endMarch, 2023 or Q1 2023 with a sample size of 13,000.

AMPD Vision was used by MPA to provide a granular view of streaming content consumption across key VOD services. Consumption and streaming minutes cited in the report are based on MPA’s proprietary weighting & projection techniques to be nationally representative for individuals aged 15 to 69.

The term Premium VOD, commonly used in the report, refers to online video-ondemand platforms that curate premium long-form content for consumers with free and paid tiers (i.e. freemium) or solely paid tiers (i.e. SVOD). Premium VOD excludes UGC and/or social video platforms such as YouTube.

Key highlights from the report include:

Premium VOD is growing engagement. Total consumption across the online video sector reached 6.1 trillion minutes for the 15-month period from Jan 2022 to Mar 2023. The Premium VOD category had a 12% share (versus 10% in 2021) with YouTube remaining dominant with 88% share. The 12% number compares well with other emerging markets (i.e. Indonesia, Thailand and Philippines) where the norm for premium VOD share is below 10% but trails more developed markets such as Australia (35%). Significantly, India is not too far behind markets such as Japan and Korea where the norm is 15-20%.

Disney+ Hotstar led premium VOD category consumption over CY 2022 / Q1 2023. Disney+ Hotstar led premium VOD category viewership with 38% share over the measured 2022-Q1 2023 period, driven by sports as well as the depth of its Hindi and regional entertainment. The combined Zee – Sony group had 13% premium VOD category share in aggregate with their respective platforms, which are expected to operate separately for another year, benefiting from strong engagement across sports as well as regional, local and international content.

Jio Cinema rises in April 2023. The measurement period in this report ended Q1 2023 before the launch of IPL on Jio Cinema. As a result, its share of the premium VOD category was limited to 2%. In April 2023, in spite of several tech glitches impacting user experience, the free live streaming of the men’s IPL cricket ensured that Jio Cinema consumption grew more than 20x in April 2023 to ensure that it dominated the premium VOD category. It remains to be seen whether its platform can maintain its growth and scale in the absence of IPL action after June 2023.

Prime Video and Netflix. During the measured period, Prime Video and Netflix had an aggregate 10% share of Premium VOD category minutes. Prime Video continues to benefit from a good mix of content across genres and languages with Crime & Thriller and Action & Adventure leading the way. Prime Video also garnered almost a third of its viewership from regional Indian titles. In aggregate, more than 60% of Prime Video’s viewership was anchored to local content. This is in contrast to Netflix where local content’s contribution to viewership was 24%. Netflix’s Indian originals have not been able to sustain their buzz for a long period of time. In contrast, various seasons of Netflix’s major US titles have achieved sustained viewership.

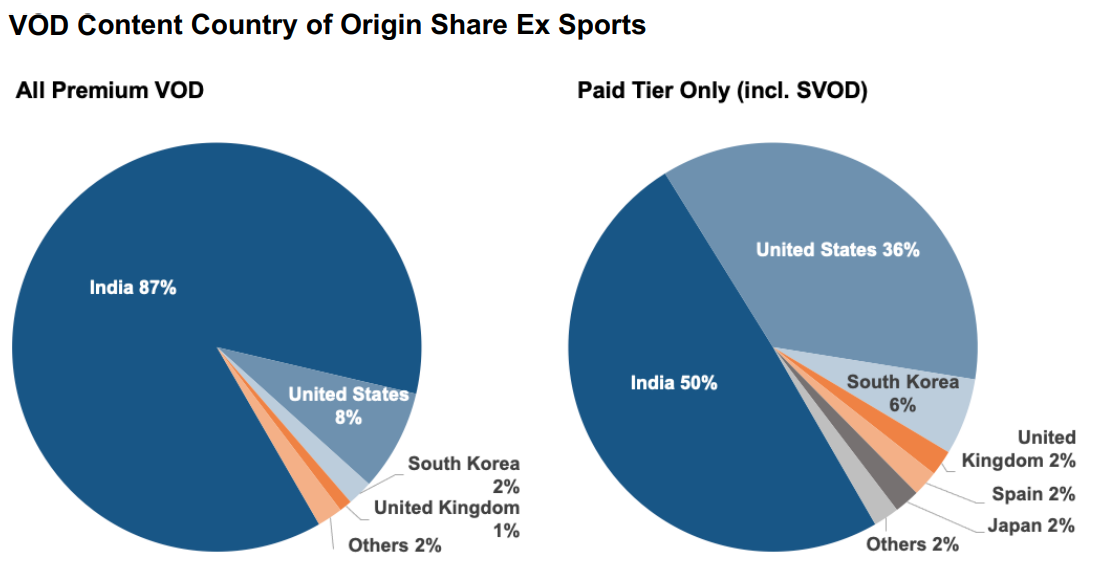

Local content dominates premium VOD viewership ex-sports; paid tiers led by international content. With catch-up TV content dominating the Free-tier across Freemium streaming platforms, Indian content dominates premium VOD viewership ex-sports. Content viewership on paid tiers was led by international content, which contributed 51% of total paid tier premium VOD consumption over 2022-23. US content remains the primary driver with 36% share while Korean content is growing and reached 6% share during the measured period. Local content contributed 49% overall to the paid tier with Indian Originals contributing 26%.

Warner Bros., Netflix Studios and Disney’s Marvel Entertainment are the leading studios in terms of share of US content viewership. Applause, Endemol, The Viral Fever, D2R Films and Excel Entertainment were the key drivers of Indian Original Series viewership.

Commenting on the findings of the report, MPA India vice president Mihir Shah said: “The next 6-12 months will remain critical for the OTT sector as platforms strive to balance monetization and profitability against content investment. Disney+ Hotstar retains a strong local entertainment platform, powered by Star’s Hindi and regional content depth. The platform’s SVOD layer should ideally consolidate and anchor its offering to remaining sports rights, led by ICC Men’s cricket, popular Marvel content, and Disney family content.

Amongst global players, we see continued momentum in the future for Amazon Prime Video, which is closing on 20 million paid subscribers. Its success is largely attributable to launch of its mobile edition, a new ad tier, Prime Video Channels, and TVOD along with a deep bench of regional content and will continue to drive growth in 2023. Netflix will continue to grow at pace though with relatively low ARPUs – its cadence of local originals remains impressive but still contributes less than 30% to overall viewership on the platform. We expect fresh bets may have a larger impact in 2H.

Finally, in spite of several tech glitches impacting user experience, the free live streaming of the men’s IPL cricket ensured that Jio Cinema consumption grew substantially in April 2023 while its average daily engagement reached 50 minutes. However, sustained viewership levels will remain critical in the absence of IPL cricket during 2H 2023 especially as the platform has increased its investment in local content and premium international content, setting the stage for the growth of its premium tier.”

Note: Analysis covers total viewership measured during Jan 2022-Mar 2023 for India; excluding Sports Source: AMPD Research, MPA Analysis

Note: Analysis covers total viewership measured during Jan 2022-Mar 2023 for India; excluding Sports Source: AMPD Research, MPA Analysis

Links: Media Partners Asia

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally