Percentage of U.S. SVOD buyers looking to cut spending up 40%

Tuesday, July 18th, 2023

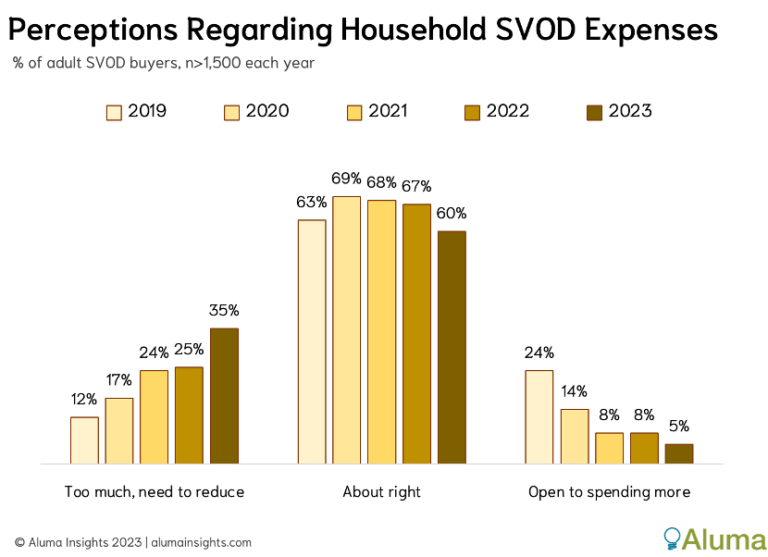

Percentage of SVOD Buyers Looking to Cut Spending Up 40% Year Over Year

New research from Aluma Insights finds 35% of subscription video-on-demand (SVOD) customers are spending too much on services like Netflix and are looking to cut back. This represents a 40% increase over the last year and threefold that of 2019. Only 5% are interested in spending more on SVOD services, down 38% from 2022.

“That only one-in-twenty SVOD buyers are open to adding a new subscription service is the latest indicator that US demand is all but exhausted,” said Michael Greeson, founder and principal analyst. “This does not mean mature SVOD providers will not add subscribers, only that such additions will be fewer, require more aggressive promotions, and be zero-sum purchases—that is, for every new service added, another must be cancelled.”

While there remain ‘green field’ opportunities for SVOD providers, broadband is available to over 90% of US households, leaving only 10% or roughly 14 million households to be served. While federal subsidies for build-outs into unserved areas may help bring many of them online, it will be years before deployments are complete. Moreover, there is no guarantee those unserved by broadband will be heavy buyers of streaming video services.

Consumers are increasingly frustrated by the growing costs of streaming video service and unfortunately there is no relief in sight. With most SVOD providers still bleeding cash, growing subscriptions has taken a backseat to optimizing revenue via higher prices, layoffs, and decreased content spending, among other measures. Add to this the ongoing strike of writers and actors, and it is all but certain the quality of content will decline even as prices increase.

On a positive note, inter-network SVOD bundles that combine services from competitive operators and offer subscribers a discount to standalone pricing, are finally attracting the interest they deserve. Intra-network bundles like Disney’s package of Disney+, Hulu, and ESPN+ have largely run their course will take a back seat to so-called ‘super bundles’ that more closely resemble pay-TV services—not MVPDs per se, but app bundles that borrow several key elements of that model.

“Content owners that have long battled head to head in the SVOD space are about to engage in strategic bundling with competitors,” said Greeson. “This is not some kumbaya moment for the streaming industry, but a strategic necessity for SVOD operators, much as joining cable TV was for over-the-air broadcasters in the 1970s. It’s about survival in an increasingly competitive marketplace.”

Each year, Aluma surveys over 8,000 US adults on their use of legacy and streaming media devices and services. In April 2023, Aluma surveyed 2,002 SVOD decision-makers that watch television at home, 1,756 (87%) of which used an SVOD service.

Links: Aluma

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally