Netflix, Hulu, Disney+ most essential for US streaming subscribers

Tuesday, March 14th, 2023

Aluma – Netflix, Hulu, and Disney+ Most Essential to Streaming Subscribers

- Being indispensable has its advantages.

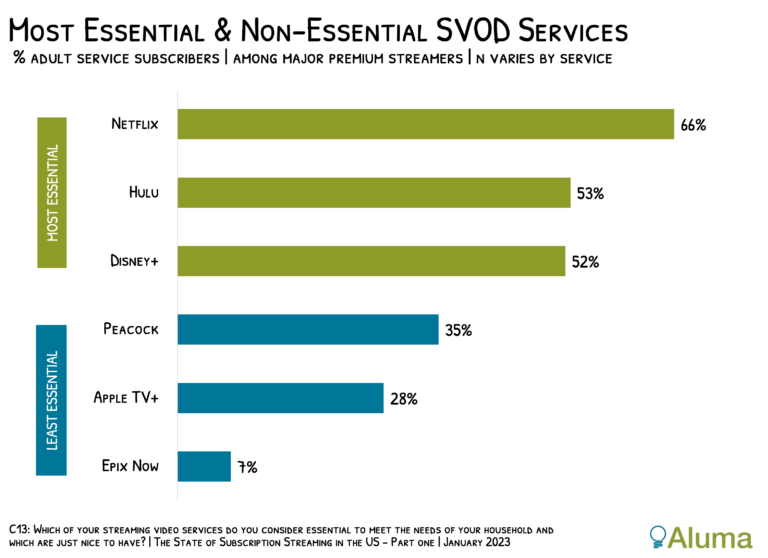

New research from Aluma Insights finds two-thirds of Netflix buyers view the service as indispensable to meeting household video needs. Hulu and Disney+ were the only other top-16 services in which more than half of subscribers considered the service essential instead of just nice to have. Conversely, Epix Now, Apple TV+, and Peacock were found to be the least essential services.

“This is a one way of comparing a service’s utility with that of its competitors,” noted Michael Greeson, veteran researcher and founder of Aluma Insights. “It says to some owners you’ve a bit more latitude when it comes to revenue optimization measures, such as cracking down on freeloading or increasing retail prices. It says to others there is great risk in significantly altering prices or service terms.”

To this point, Disney CEO Bob Iger recently said December’s 38% increase in ad-free Disney+ prices resulted in only minor subscriber losses, suggesting the service is not yet fully valued. Aluma analysts agree, and expect both Disney+ and Hulu standalone prices will increase by around 15% during 2023.

The fact Netflix, Hulu, and Disney+ topped the essentials list, and Epix Now finished last, was unsurprising to Aluma analysts. However, Apple TV+ and Peacock being among the bottom three was unexpected. Apple TV+ is recognized for high-quality original content that resonates well with its subscribers. Then again, it has little depth in terms of third-party content and subscribers rank its value poorly relative to competitors.

Peacock saw sizable growth in paid subscribers during 2022, of which two-thirds consider the service inessential, largely the result of library neglect. With Comcast eliminating the free Peacock tier, and phasing out complimentary service for Xfinity subscribers, prioritizing quality of content will be key to meeting the company’s conversion goals. This expectation faces significant challenges, including convincing Xfinity users Peacock is worth yet another fee.

The greater risk to less-essential services is plateauing monthly SVOD spending. Aluma found that in 2022 SVOD households spent on average $43.25 per month on the services, up significantly from 2020 but mostly stable compared with 2021. However, between 2020 and 2022, the percentage of SVOD buyers open to spending more declined from 14% to 8%, while the percentage who planning to reduce these expenses increased from 17% to 25%.

About Aluma’s Original SVOD Research

Aluma recently surveyed nearly 2,000 US household decision-makers that pay for at least one SVOD service on a variety of topics, including the number of SVOD services paid for versus used, monthly spending, service value, proclivity to cancel, interest in inter-network SVOD bundles, TV viewing by service and device type, and much more.

Links: Aluma

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally