BB Media & DEG International publish International Digital Entertainment report

Tuesday, June 27th, 2023

‘International Digital Entertainment: the Platforms & the Players’

- BB Media and DEG International present this ground-breaking report with global streaming data

It is no surprise that the Media and Entertainment industry has been experiencing a wildly accelerated evolution in the past few years. One of the main reasons? The ever-growing expansion of streaming platforms, their catalogs, plans and revenue models.

With this reality in mind, BB Media partnered with DEG International and created the ‘International Digital Entertainment’ report that outlines the industry’s evolution, penetration and value in different markets across the world, as well as the consumers’ engagement and preferences.

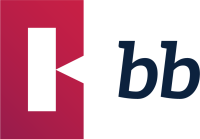

The data was collected through BB Media’s reports and services and covers SVOD, AVOD, EST, FAST, PAY TV and TVOD, up to and including Q1 2023. Also, it draws a profile on Australia, Brazil, France, Germany, Italy, Japan, Mexico, the Nordics, South Korea, Spain and the United Kingdom.

In the competition for the largest library, the United Kingdom takes the lead (229K) followed by Japan (202K) and South Korea (198K), with Italy (183K) and Brazil (171K) in fourth and fifth positions. The UK is also the country with the most announced titles in production in 2023 (27), most of which are intended for Netflix’s catalogue.

While most countries have a penetration rate of over 75% of viewers who watch content online, Brazil has a penetration rate of just 46%. If we were to zoom-out, we would see that in LATAM in general, the level of online viewing is 47%. However, on average, 6 different platforms are used to watch content, making it the region with the highest usage of platforms.

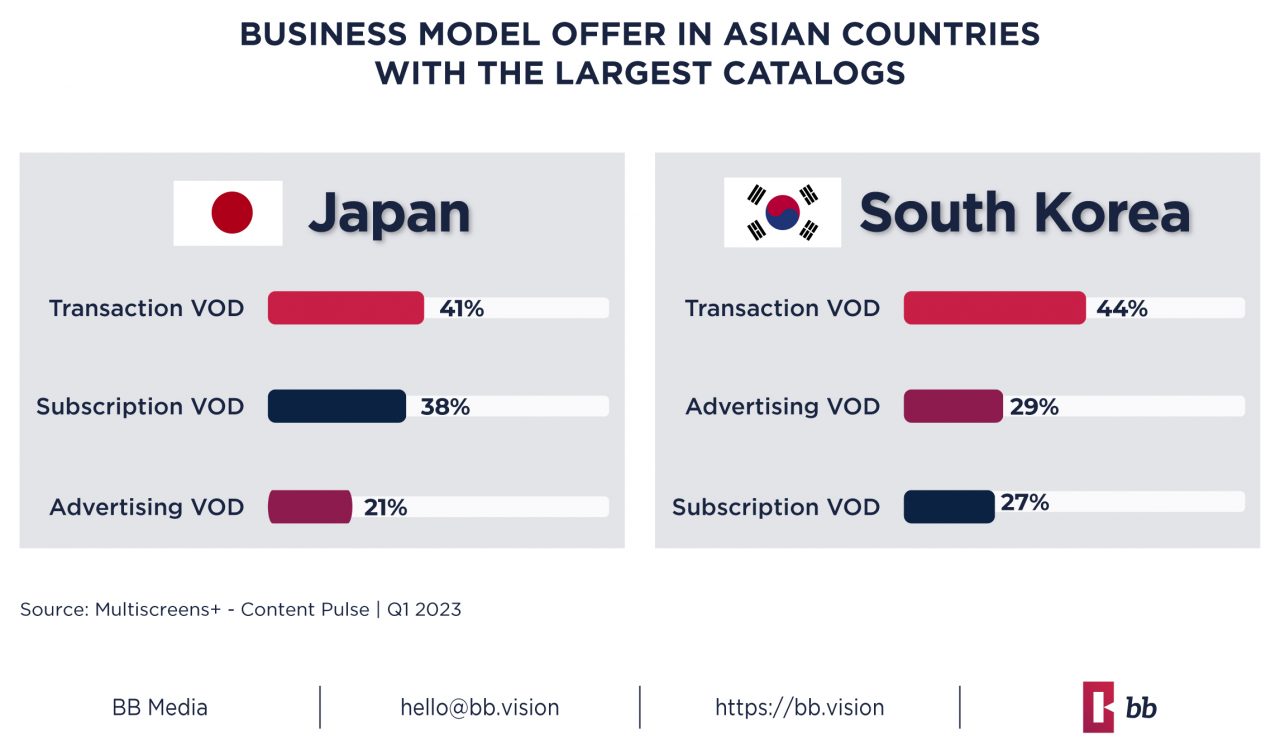

It was possible to identify that the advertising revenue model is taking the world by storm, particularly in North America where AVOD penetration is highest, with 75% in the US and Canada, while LATAM has a penetration of 37% and EMEA of 60%. In APAC, where SVOD is the preferred way to watch for 82% of viewers, AVOD penetration is just 40%, highlighting a strong preference in the market to pay for ad-free content. This does not align with the offer in these countries as it was found that in Japan and South Korea (the ones with the largest catalog in the region) the predominant revenue model is the Transaction VOD.

This is just a peak of the insightful data that the ‘International Digital Entertainment’ report has to offer. As we look ahead, the future of the streaming industry holds exciting possibilities, and it is with information like the one presented here that will make adapting to these advancements easier, preparing players and buyers for what is to come.

Joe Braman (Co-Chair, Digital Entertainment Group International & SVP International Digital Account Management) declared: ‘As we watch SpaceX create a paradigm shift in space exploration, one where innovators try faster and fail faster too, our industry is embarking on its own new era of experimentation. With the white heat of innovation all around us, the role for reports like this is to connect and channel that energy into valuable entertainment discoveries that benefit everyone’.

Tom Gennari (CEO at BB Media) added: ‘The Audiovisual Industry won in globalization, developed in localization, and achieves its greatest splendor in the globalization of the local. This is only possible thanks to the collaboration of all companies that are part of this value chain. The work done by BASE and DEGI is fundamental for this global and local interconnection to happen’.

Links: BB Media; DEG International

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally