MPA releases 1H 2023 Southeast Asia online video report

Wednesday, August 2nd, 2023

Southeast Asia Online Video Consumer Insights & Analytics Report, 1H 2023

- Viu, Amazon & Netflix Grow Subscriptions Amidst Broad Market Slowdown

- Korean, Local, US and Asian Content Continues to Drive Premium VOD Category Viewership & User Acquisition

- TikTok Drives Viewership Growth in SEA

SINGAPORE — The Southeast Asia (SEA) region added only 7,000 net new SVOD subscriptions in in 1H 2023, a marked slowdown from more than 7.0 million net new additions in 2H 2022 and 3.7 million net adds in 1H 2022, according to Media Partners Asia’s (MPA) latest Southeast Asia Online Video Consumer Insights & Analytics report. The report tracks key metrics across the online video category with fused passive and establishment panels operated by MPA subsidiary AMPD in five SEA markets: Indonesia, Malaysia, the Philippines, Singapore and Thailand.

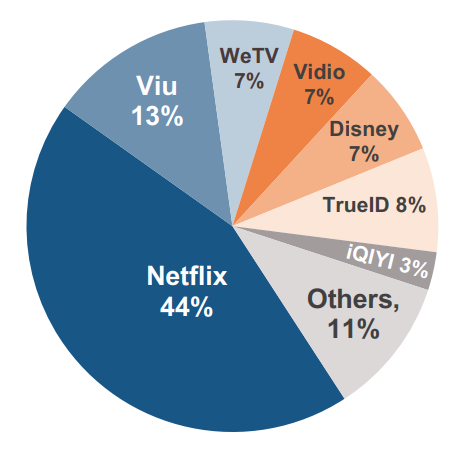

SEA had 47.6 million SVOD subscriptions at the end of 1H 2023, flat in comparison with year-end 2022. Subscriber growth in Thailand, Malaysia and the Philippines was offset by contraction in Indonesia, where total subscriptions fell by 1.2 million. The report attributes the SVOD slowdown in 1H 2023 to a combination of factors including: (1) Subscriber churn in Indonesia following the end of the FIFA World Cup football tournament in December 2022 and the end of the 2022-23 Premier League season in May 2023; (2) The impact of significantly reduced local marketing and content investment outside of Netflix, Prime and Viu, who all contributed to regional growth in 1H 2023 and the result of price increases implemented by key platforms.

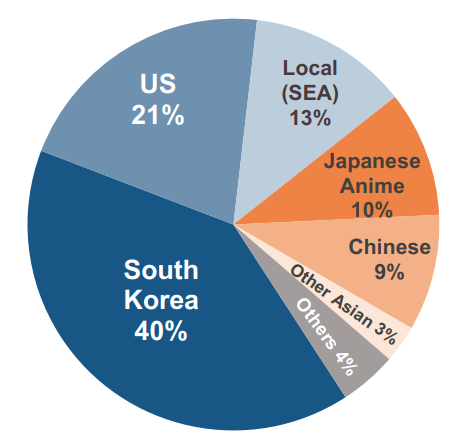

Offsetting the decline from contracting platforms, Viu, Amazon Prime Video, and Netflix added an aggregate 1.2 million customers, accounting for 63% of new subscriptions among growing platforms. All three tap into the popularity of Korean dramas, the single largest content category in SEA premium VOD. 53% of premium VOD users streamed some Korean content, capturing 40% of premium VOD viewership in SEA in 1H 2023. Strong exclusive slates from Netflix and Viu drove demand, with The Glory (Netflix) and Taxi Driver S2 (Viu) leading. All leading premium VOD services are also investing in Southeast Asian content, with 50% of SEA’s premium VOD audiences viewing local content in 1H 2023. Thai content has the strongest regional impact, with Netflix’s thriller movie Hunger topping regional travelability in 1H 2023.

On the outlook for growth in SEA, MPA executive director Vivek Couto commented: “The region’s leading premium VOD platforms are in the midst of a shift towards quality customer growth, retention, and monetization. Netflix has reduced prices and introduced member sharing measures while Disney has raised prices in Indonesia and Thailand in an effort to build lowchurn, high ARPU customer bases. We expect Vidio in Indonesia to pick up subscribers with the return of Liga 1 and the Premier League in 2H, along with impactful local slates from Netflix and Amazon, particularly in Thailand and Indonesia, attracting new subscribers, while Viu will continue to benefit from its Korean output. In the larger online video landscape, TikTok is increasingly a major driver of viewership growth on mobile and web platforms, responsible for over 70% of growth in streaming minutes over the past 2 years. TikTok captured 42% of video streaming minutes in 1H 2023, a massive 20-point increase over 1H 2021 and 7-point increase from 1H 2022. While overall engagement is growing, TikTok’s rise has reduced shares for YouTube (-4%) and Premium VOD (-2%) Y/Y.”

Links: Media Partners Asia

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally