Set-Top Box Shipments Rise in 2009 Despite Economic Downturn

Monday, August 24th, 2009

Defying the current economic turmoil, global Set-Top Box (STB) shipments are expected to rise in 2009 due to rising demand from Asia and from products supporting High Definition (HD), Digital Video Recording and Internet Protocol Television (IPTV), according to iSuppli Corp.

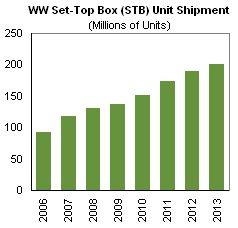

Worldwide STB shipments are set to grow to 136.7 million units in 2009, up 4.2 percent from 131.2 million in 2008. Shipments will rise to nearly 200 million systems by 2013, growing at a Compound Annual Growth Rate (CAGR) of 9 percent during the forecast period. STB sales have continued to expand during the worse phase of the current downturn.

Worldwide STB shipments are set to grow to 136.7 million units in 2009, up 4.2 percent from 131.2 million in 2008. Shipments will rise to nearly 200 million systems by 2013, growing at a Compound Annual Growth Rate (CAGR) of 9 percent during the forecast period. STB sales have continued to expand during the worse phase of the current downturn.

“In the fourth quarter, when the wheels were literally coming off of the world’s economies, the leading STB makers were reporting surging sales,” said Jordan Selburn, principal analyst for semiconductor design and STBs at iSuppli.

“This phenomenon carried over into 2009 and beyond with first-quarter shipments of STBs. And while they were down from the fourth-quarter holiday season, they were still ahead of the first quarter from 2008–an unusual event for any product in today’s depressed electronics market.”

Athough terrestrial and satellite STB shipments were essentially flat during this time period, cable boxes have showed very strong growth, driven in particular by increasing rollouts in China and other parts of the Asia-Pacific region. Internet Protocol Television (IPTV) STBs are continuing to proliferate as well, shipping over 50 percent more systems in 2008 than during the previous year. The growth of IPTV STBs nearly matched that of cable in terms of the number of systems shipped in 2008.

Must-See STBs

“Premium boxes–like DVR-enabled STBs and HD products–will grow at a substantially higher rate than the 4.2 percent level for the overall STB market in 2009, Selburn said. “These STBs will buoy the entire market as non-DRV and standard-definition from this point forward.”

Shipments of premium boxes in 2008 almost doubled to 22.4 million systems. This growth will continue to be substantial in 2009, with a 28 percent rise.

“This is a strong growth number for any era, but considering the state of the economy and business environments, it is even more impressive,” Selburn said.

Among premium boxes, HD STBs are on their way to becoming the new standard in the home. Shipments of these boxes are set to grow at a 22.8 percent CAGR between 2008 and 2013, and by the end of the forecast period will take the lead in market share. This is being helped by a number of factors, including HD display sales, increasing access to broadband technology and improving HD content from service providers.

DVR-enabled boxes are growing at a rapid rate as well and will maintain a CAGR of 18 percent through 2013. The plummeting cost of hardware–especially Hard Disk Drives (HDDs)–is making the DVR HDD a more affordable purchase for consumers. However, rising sales of whole-home DVRs used as in-home media servers will continue to push sales of non-DVR boxes that act as clients to a central STB containing a hard drive.

Read More About the Set-Top Box Market with iSuppli’s Newest Report, An Oasis of Opportunity in a Barren Market.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally