Video services market expected to top $250 billion in 2014

Tuesday, June 1st, 2010

CAMPBELL, California — Market research firm Infonetics Research released the first edition of its 2010 biannual Video Services and Subscribers report, which tracks telco Internet Protocol television (IPTV), cable video, and satellite video services and subscribers.

Analyst Note

“Increased competition among video service operators will help keep monthly subscription fees in check, which will offset some of the growth expected from incremental revenue via video on demand, digital video recording, and ‘start-over’ services. However, the biggest threat to revenue growth is the continued rise of online (over-the-top) viewing, where users can simply eliminate their monthly TV subscription in favor of streamed programming delivered over the Internet via sites like Hulu and YouTube, and aggregating by services such as Boxee,” notes Jeff Heynen, directing analyst for broadband and IPTV at Infonetics Research.

Video Services Market Highlights

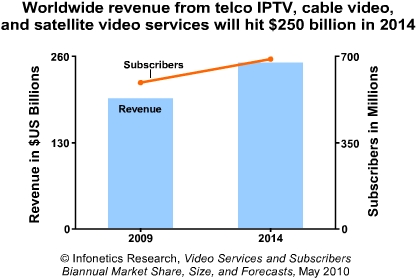

- Worldwide revenue derived by service providers and cable companies for IPTV, cable video, and satellite video services is forecast to top $250 billion in 2014

- Average revenue per user (ARPU) for telco IPTV services in most regions remains lower than ARPU for cable and satellite services

- Still, telco IPTV service revenue is forecast to grow nicely over the next five years, good news for service providers trying to stem the loss of revenue from decreasing fixed access lines

- Operators such as AT&T, Verizon, Belgacom, Deutsche Telekom, Orange, Iliad, and China Telecom are adding video subscribers at a rapid clip, selling them on a combination of exclusive content, higher picture quality, and introductory rates that are below similar offerings from cable and satellite service providers

- In North America, the top two providers of video services in terms of annual revenue are Comcast and DIRECTV

- In EMEA, Sky is the revenue share leader by far, with its presence in the UK, Ireland, Germany, Italy, and Austria

Report Synopsis

Infonetics’ biannual Video Services and Subscribers report provides in-depth analysis and worldwide and regional market size and forecasts for telco IPTV services (pure IPTV, hybrid IPTV/over-the-air, and hybrid IPTV/QAM), basic and digital cable video services, and satellite video services. The report also provides service provider market share in North America and EMEA for total video services, telco IPTV video services, cable video services, and satellite video services.

Market share is tracked for AT&T, Bell Canada, Cablevision, Canal Digital, CanalSat, Charter, Comcast, Cox, Deutsche Telekom, Digiturk, DirecTV, Dish Network, France Telecom, Illiad, Kabel Deutschland, KPN, MTS Allstream, Numericable, SaskTel, Shaw, Sky, SureWest, Telefónica, Time Warner Cable, UnityMedia, UPC Broadband (Liberty Global), Verizon, Virgin Media, and many others.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally