DOCSIS channel shipments rose to record levels in 2014

Friday, February 27th, 2015

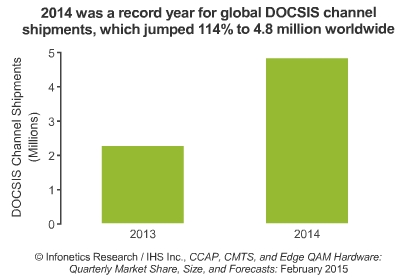

Cable Broadband Speed Battles Rage as Operators Invest in a Record 4.8 Million DOCSIS Channels in 2014

CAMPBELL, California — Technology market research firm Infonetics Research, now part of IHS Inc. (NYSE: IHS), today reported that Data Over Cable Service Interface Specification (DOCSIS) channel shipments rose to record levels in 2014 — up 114 percent to 4.8 million worldwide — as cable operators continue to improve their networks to offer services to customers at ever-higher speeds.

Infonetics’ fourth quarter 2014 (4Q14) and year-end CCAP, CMTS, and Edge QAM Hardware report tracks cable broadband subscribers and equipment including converged cable access platforms (CCAPs), cable modem termination systems (CMTSs), coaxial media converters (CMCs) and edge quadrature amplitude modulation (QAM) channels.

“The continued growth of DOCSIS channel shipments is a strong sign of multiple system operators’ (MSOs’) ongoing investment to ramp DOCSIS bandwidth and services like IP video by splitting optical nodes and reducing service group sizes via CCAP,” said Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

“We look for the upward trend in channels on CCAP and CMTS platforms to continue to grow as operators prepare their networks for DOCSIS 3.1 and remote physical (R PHY) architectures, though the growth will come principally from CCAP products,” Heynen said.

MORE CABLE BROADBAND MARKET HIGHLIGHTS

- Globally, CCAP, CMTS, edge QAM and CMC equipment revenue totaled $493 million in 4Q14, an 11 percent sequential increase

- For the full-year 2014, worldwide sales of CCAP, CMTS, edge QAM and CMC gear grew 27 percent from the prior year, to $1.7 billion

- 2014 will be remembered as a transitional year from traditional CMTS to provisional CCAP deployments: From 2013 to 2014, CCAP revenue increased 997 percent to $1.4 billion, while CMTS revenue dropped 84 percent to $155 million

- The transition from CMTS to CCAP resulted in interesting market share shifts in 2014: Arris dominated the cable broadband market, capturing 48 percent of global revenue, while Cisco had one of its most disappointing years for CCAP/CMTS sales

- Casa Systems also had a record 2014, growing revenue 195 percent from 2013

- In the key market of North America, DOCSIS channel shipments were up 139 percent in 2014 over the previous year, and revenue was up 35 percent

- Infonetics expects the pending merger between Comcast and Time Warner Cable to have a direct impact on the North American region in the early part of 2015, exacerbating the usual first quarter slowness

- N. American CCAP, CMTS, CMC and edge QAM channel shipments are forecast by Infonetics to drop 7 percent sequentially in 1Q15

CABLE HARDWARE REPORT SYNOPSIS

Infonetics’ quarterly CCAP, CMTS, and edge QAM report provides worldwide and regional market size, vendor market share, forecasts through 2019, analysis and trends for CCAP, CMTS, CMC and edge QAM (linear broadcast, VoD and unicast video, switched digital video, and DOCSIS/M CMTS) equipment and cable broadband subscribers (standard and wideband). Vendors tracked: Arris Group, Casa Systems, Cisco Systems, Ericsson, Harmonic Inc., Huawei, others.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally