One third of cable subscribers to be passed by DOCSIS 3.1 by April 2017

Tuesday, July 28th, 2015

Biggest Trend among Cable Operators: Massive DOCSIS Deployments and a Shift to Remote/Distributed Access

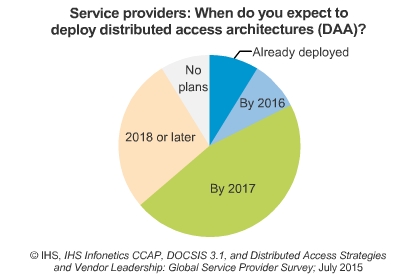

CAMPBELL, California — IHS (NYSE: IHS) conducted in-depth interviews with cable operators across the globe that collectively control 87 percent of the world’s cable capex and found that 42 percent of them plan to deploy a distributed access architecture (DAA) by 2017.

In the study, CCAP, DOCSIS 3.1, and Distributed Access Strategies and Vendor Leadership: Global Cable Operator Survey, respondent operators say their primary choices for distributed access are R-PHY, R-MACPHY and R-CCAP.

“Cable operators are clearly committed to both DOCSIS 3.1 and distributed access architectures to increase bandwidth in their access networks. Though there is no consensus yet on which distributed access technology most will use, there’s no question they will distribute some portion of the DOCSIS layer to their optical nodes,” said Jeff Heynen, research director for broadband access and pay TV at IHS.

MORE CABLE SURVEY HIGHLIGHTS

- The operational benefits cable operators are reaping from moving from CMTS to CCAP are just the first step in a long-term transition to distributing data processing capabilities throughout the network

- Survey respondents, on average, say that about a third of their residential subscribers will be passed by DOCSIS 3.1-enabled headends by April 2017

- By 2017, nearly half of respondents will have return path (upstream) frequencies of 86–100MHz, while a quarter will have 101–200MHz of return path spectrum

ABOUT THE REPORT

The 29-page IHS Infonetics study, led by IHS analyst Jeff Heynen, focuses on DOCSIS 3.1, converged cable access platforms (CCAPs) and distributed access architectures, and how and when cable operators will deploy these technologies and architectures to improve their broadband and IP service offerings over the next 2 years. The study includes operator ratings of CCAP and distributed access equipment suppliers (Arris Group, Casa Systems, Cisco Systems, Gainspeed, Harmonic Inc, Huawei and Pace plc/Aurora) on 9 criteria.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally