Satellite and IPTV Gaining Fast on Cable Video; Netflix, Amazon Threat Insignificant So Far

Tuesday, November 1st, 2011

CAMPBELL, Calif. — Market research firm Infonetics Research today released excerpts from its Pay TV Services and Subscribers report, which forecasts and analyzes the telco Internet protocol television (IPTV), cable video, and satellite video services markets.

ANALYST NOTE

“In 2008, cable video made up 59% of the global pay TV market, satellite video brought in 38% and IPTV was just a drop in the bucket. Now cable operators are being challenged not only by attractive pricing and services from IPTV and satellite operators, but by all over-the-top (OTT) video services, like Netflix and Amazon On-Demand, and by connected-TV devices, which are prompting consumers to cut the cord. Net new cable video subscribers continue to decline in North America and EMEA, and the small increases in Asia and Central and Latin America aren’t offsetting those declines. While we don’t expect OTT to have a significant impact on pay TV subscribers because operators are responding to OTT with their own enhanced delivery offerings, we do expect cable video’s share of pay TV revenue to decline as satellite video increases — nearly catching up to cable by 2015 — while IPTV services grow to 15% of the market,” notes Jeff Heynen, directing analyst for broadband access and video at Infonetics Research.

“In 2008, cable video made up 59% of the global pay TV market, satellite video brought in 38% and IPTV was just a drop in the bucket. Now cable operators are being challenged not only by attractive pricing and services from IPTV and satellite operators, but by all over-the-top (OTT) video services, like Netflix and Amazon On-Demand, and by connected-TV devices, which are prompting consumers to cut the cord. Net new cable video subscribers continue to decline in North America and EMEA, and the small increases in Asia and Central and Latin America aren’t offsetting those declines. While we don’t expect OTT to have a significant impact on pay TV subscribers because operators are responding to OTT with their own enhanced delivery offerings, we do expect cable video’s share of pay TV revenue to decline as satellite video increases — nearly catching up to cable by 2015 — while IPTV services grow to 15% of the market,” notes Jeff Heynen, directing analyst for broadband access and video at Infonetics Research.

PAY TV MARKET HIGHLIGHTS

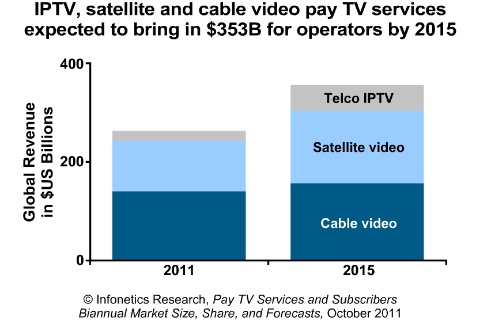

- The global pay TV market, including telco IPTV, cable and satellite video services, totaled $125 billion in the first half of 2011 (1H11) and is forecast by Infonetics Research to grow to $353 billion by 2015

- Most of the future growth in the pay TV market will come from satellite video and telco IPTV services

- North America remains the highest-value pay TV market, benefitting from the highest average revenue per user (ARPU), followed by Asia Pacific, which benefits from a pay TV subscriber base nearly 4 times the size of that of North America

- DirecTV and Comcast are the global market leaders for pay TV service revenue and subscribers in 1H11, respectively, with DirecTV continuing to enjoy the highest ARPU in the industry and Comcast now with 22.5 million subscribers

- In the first half of 2011 (1H11), the top 20 pay TV revenue leaders accounted for 52% of the revenue, while the top 20 subscriber leaders represented just 29% of the subscribers

REPORT SYNOPSIS

Infonetics’ biannual Pay TV Services and Subscribers report provides worldwide and regional market size, service provider revenue and subscriber market share, forecasts, and in-depth analysis for telco IPTV, analog and digital cable video,, and satellite video services. The report includes pay TV revenue and subscriber market share for Airtel, America Movil, AT&T, Bell Canada, BSkyB, Cablevision, Canal Digital, CanalSat, Charter, Comcast, Cox, CTC, Deutsche Telekom, DirecTV, DISHTV, DISH Network, France Telecom, Iliad, Kabel Deutschland, KPN, KT, LG, NET Serviços, Oi TV, SaskTel, SK Telecom, SkyTV, Sky Mexico, SureWest, Tata Sky, Telefónica, Time Warner Cable, UPC Broadband (Liberty Global), Verizon, Virgin Media, and others.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally