Market for services on connected TVs to reach €2.4 billion in 2016

Wednesday, March 21st, 2012

In 2016, OTT video services on connected TV will represent 17% of the total OTT market and 1% of the global fixed video services market

MONTPELLIER — The television sector is facing a profound restructuring, as players from formerly disparate sectors, such as TV, Internet and equipment vendors converge on the market. IDATE has decided to monitor the market trends affecting the market through a three level approach providing end user devices & video services market data, highlighting innovation pulses and key players’ moves. The following analyses are an extract of one of our monthly published World Connected TV Market Insights.

“In 2016, the VoD market for the TV will be dominated by Over-The-Top (OTT) offers. In Europe, we estimate the global market for OTT video services on connected TVs at EUR 2.4 billion in 2016, with Europe and North America representing respectively 17% and 54%”, says Jacques Bajon. “Managed network players – cable and IPTV providers, for instance – are holding one of the key drivers for the Connected TV market development. They can continue their strategy of service distribution or open massively their networks to over-the-top services giving a boost to their commercial offers.”

Global market for video services on connected TV

We estimate that the global market of services on connected TVs will reach EUR 2.4 billion in 2016. This market will represent 16.7% of the OTT video market and about 1% of the global fixed video services market. These figures correspond to our overall analysis of the deployment of connected TV services, which concluded that the conditions for the launch of new services are still not completely met in early 2012 and sets the likely date of the market take-off at 2015.

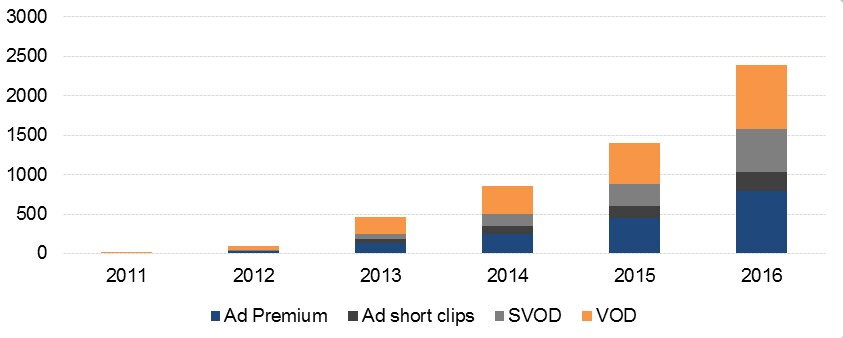

Evolution of the market of video services on connected TV worldwide, 2011-2016 (million EUR):

Source: IDATE, World Connected TV Market, February 2012

Breakdown by service

We anticipate that paid services will play a leading role in the development of connected TV services. We are indeed currently nearing the end of a double phenomenon known as cord-cutting (in which consumers will combine free access to linear television via digital terrestrial and satellite with a fee-consumption via OTT services) and cord-shaving (in which consumers will scrap their paid cable and IPTV plans for low cost OTT offers or a limited consumption of VOD services). Globally, we believe that the paid services will represent 57% of the market for video services on connected TV.

Breakdown of the global market for video services on connected TV, 2016:

VOD 37% Ad Premium 32% SVOD 20% Ad short clips 11%

Source: IDATE, World Connected TV Market, February 2012

With respect to advertising revenue, we believe that they will be primarily derived from the operation of premium programs. Consumption of short programs and of UGC contents is likely to remain largely limited to PCs, smartphones and tablets.

Geographical distribution

Given the pioneer position of the United States with respect to attractive OTT service offerings, we predict that they will remain the largest market for connected TV services, harbouring up to 50% of the total market.

Breakdown of the global market for video services on connected TV by region, 2016:

North America 54% Europe 31% Asia Pacific 9% Latin America 6%

Source: IDATE, World Connected TV Market, February 2012

The impact on the global broadcasting market

We come to the conclusion that the overall development of OTT offerings, in particular on connected TV, will significantly affect the linear TV market, and in different proportions depending on the region.

In the US, we anticipate a decrease of this market, due in particular to the reduced rates of pay television in the wake of competition from OTT services. However, over the period, we expect a growth of the global market (both linear television and new services) at current currency values, but probably a decrease in real terms. We believe in particular that the market could shrink towards the end of the period.

We anticipate a more favorable development in Europe. On the one hand, in developed European markets, we believe there is still some growth potential for pay TV and that the level of prices will limit the impact of competition on linear TV offers. On the other hand, Central and Eastern European countries offer a high growth potential.

Outside these areas and Japan, the development of OTT offers, which will come later, will not weigh on the growth of the traditional broadcasting market over that period.

Compared growth rates of linear and new TV services:

AAGR* of linear AAGR* of the global Region TV (2011-2016) market (2011-2016) ------ --------------- ------------------- Europe 5.4% 6.9% North America -0.1% 1% Asia-Pacific 9.4% 10.2% Latin America 12.5% 13% World 4.4% 5.4%

AAGR: Annual average growth rate

Source: IDATE, World Connected TV Market, February 2012

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally