FTTH/B now passes more than half of homes in EU39

Wednesday, May 12th, 2021

New Fibre Market Panorama 2021 data presented by FTTH Council Europe reveal:

- Number of homes passed by fibre (FTTH/B) reaches nearly 183 million homes in EU39;

- France, Italy, Germany and the UK have the biggest increase in Europe in number of homes passed;

- Three countries are accounting for almost 60% of homes left to be passed with fibre in the EU27+UK region;

- FTTH/B Coverage in Europe surpasses more than half of total homes;

- 16.6% growth in the number of fibre subscribers;

- Iceland leads the European FTTH/B league table second year in a row;

- Belgium, Israel, Malta and Cyprus enter the FTTH/B ranking for the first time.

BRUSSELS — Today the FTTH Council Europe revealed the 2021 Market Panorama and the latest figures outlining fibre deployment trends in Europe prepared by IDATE.

Market Panorama & key findings:

The total number of homes passed with Fibre to the Home (FTTH) and Fibre to the Building (FTTB) in the EU39[1] reached nearly 182.6 million homes in September 2020, compared to 172 million in September 2019. The main movers in terms of homes passed in absolute numbers are France (+4,6 M), Italy (+2,8 M), Germany (+2,7 M) and the UK (+1,7 M). The top 5 of the annual growth rates in terms of homes passed is headed by Belgium (+155%), Serbia (+110%), Germany (+66%), United Kingdom (+65%) and Ireland (+49%).

This year[2], a key milestone has been reached, as FTTH/B Coverage in EU39 now amounts to more than half of total homes. By September 2020, EU39 reached a 52.5% coverage of FTTH/B networks while EU27+UK[3] sits at 43.8%, compared to respectively 49.9% and 39.4% in 2019. This shows a clear upward trend from the September 2015 figures when the coverage was at 39.8% in EU39 and 27.2% in EU27+UK.

The number of FTTH and FTTB subscribers in Europe increased by 16.6% in EU39 in the year since September 2019 with 81.9 million FTTH/B subscribers in September 2020. Russia still plays a major role in this increase, however, it is interesting to note that the EU27+UK experienced a 20.4% increase on its own.

This year, the country adding the most subscribers is located in Western Europe. France added 2.787.000 new FTTH/B subscriptions, whereas Russia came second adding 1.681.000 new FTTH/B subscribers. Spain rounds out the top 3 with 1.436.000 new FTTH/B subscribers. Other countries also experienced an outstanding increase in their number of subscribers such as Turkey (+ 718.000) and Germany (+ 694.000).

By September 2020, the EU39 FTTH/B take-up[4] rate raised to 44.9% in comparison to the 43%[5] rate registered by September 2019. For the third consecutive year, the take-up rate for EU27+UK surpasses the EU39’s one by reaching 46.9% (as opposed to 43.3% in September 2019).

Fibre technologies have been continuously evolving during the last few years with a predominance of FTTH architecture over FTTB (63% vs 37%). Alternative Internet Service Providers are still constituting the largest part of FTTH/B players, with a contribution of around 57% of the total fibre expansion. It is interesting to note that many countries where legacy infrastructure still dominates have modified their strategy deploying more FTTH solutions, migrating from existing copper based and cable-based networks towards fibre and are even intensifying copper switch-off. Nevertheless, three historically copper-strong countries (UK, Germany and Italy) are accounting for almost 60% of homes left to be passed with fibre in the EU27+UK region. The ongoing COVID-19 pandemic, in turn, has demonstrated the necessity of both FTTH deployments and adoption. The governments and local authorities are increasingly involved in the digital transformation, introducing revised national programmes, subsidies and relevant policy framework to promote fibre expansion.

“The telecoms sector can play a critical role in Europe’s ability to meet its sustainability commitments by reshaping how Europeans work, live and do business. As the most sustainable telecommunication infrastructure technology, full fibre is a prerequisite to achieve the European Green Deal and make the European Union’s economy more sustainable. Competitive investments in this technology should, therefore, remain a high political priority and we look forward to working with the EU institutions, national governments and NRAs towards removing barriers in a way to full-fibre Europe” said Vincent Garnier, Director General of the FTTH Council Europe.

European FTTH/B Ranking

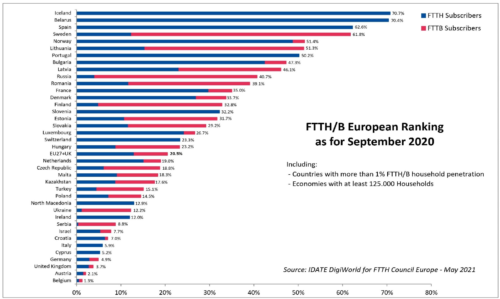

Iceland tops the European FTTH/B penetration ranking for the second consecutive year with a 70,7% penetration[6] rate.

Iceland remains a leader in FTTH/B penetration, championing the ranking followed closely by Belarus (70,4%). Spain (62.6%) reclaims the third position from Sweden (61.8%) and assumes the last spot on the podium of fibre leaders.

This year, four countries have entered the FTTH/B penetration ranking (as opposed to no entries in last year’s report), namely Belgium, Israel, Malta and Cyprus.

Belgium, Israel, Malta and Cyprus enter the European Fibre Ranking

- By September 2020, the fibre market in Belgium is still nascent but it has been growing rapidly; the FTTH/B subscriptions grew by 42% and FTTH/B Homes Passed by 155% (compared to September 2019). Belgium currently ranks last among European countries but, given the ambitious initiatives towards full-fibre, the country is on track to experience a significant upturn of FTTH connections in the coming years.

- This year, the evolution towards fibre in Israel has been substantial; FTTH/B subscriptions grew by 64% and FTTH/B Homes Passed by 25%, compared to September 2019. By September 2020, 7.7% of Israeli households were subscribed to FTTH, surpassing Italy (5.9%) and the United Kingdom (3.7%).

- By September 2020, Malta’s fibre market has experienced significant growth: FTTH/B subscriptions grew by 27% and FTTH/B Homes Passed by 35% (compared to Sept. 2019). Furthermore, 18.3% of Maltese households were FTTH customers by September 2020, above United Kingdom (3.7%) but far below Sweden (61.8%) or Spain (62.2%).

- By September 2020, 5.2% of Cypriot households were FTTH customers, a percentage that places Cyprus above United Kingdom (3.7%) and Germany (4.9%) but far below Malta (18.3%) or Iceland (70.7%).

“The data of this new edition of our Market Panorama confirms that fibre roll-outs are taking place at an increasingly faster pace in Europe, and the EU is making a very significant – though uneven – progress in meeting its connectivity targets. This year’s report demonstrates that 3 European economies that have recently intensified their fibre rollout – Germany, Italy, and the UK – still account for almost 60% of the entire remaining homes to be passed in the EU27+UK region” commented Eric Festraets, President of the FTTH Council Europe. “This further demonstrates that the implementation of the new European Electronic Communications Code and in particular of its Very High Capacity Networks provision will be essential to meet the ambitions of “Europe’s Digital Decade” and a greater digital empowerment by 2030.”

1. The EU 39 includes Andorra, Austria, Belarus, Belgium, Bulgaria, Croatia, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Kazakhstan, Latvia, Lithuania, Luxembourg, Malta, Macedonia, Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine and United Kingdom

2. Between September 2019 and September 2020

3 The EU 27 + UK includes Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom

4. Take-up=Subscriptions/Homes Passed

5. Figures recalculated using a bottom-up approach.

6. Penetration rate = FTTH/B Subscriptions / Households

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally