FTTH Council Europe updates FTTH/FTTB figures

Thursday, March 14th, 2019

New Market Panorama and Forecast data at the FTTH Conference 2019 reveals:

- a 21% increase in number of subscribers;

- FTTH/B Coverage reaches 36,4%;

- Italy has the higher growth in homes passed at 43.1%;

- the UK enters the ranking.

AMSTERDAM — Today at the FTTH Conference 2019, the latest figures of the FTTH Market Panorama prepared by IDATE were released. Forecasts for 2020 and 2025 were also revealed for the first time.

Market Panorama & key findings:

The number of fibre to the home (FTTH) and fibre to the building (FTTB) subscribers in Europe increased by 15.7% in EU39(1) since September 2017 with more than 59.6 million FTTH/B subscribers in September 2018. Although Russia is the leader in terms of FTTH/B subscribers in the European region, it has showed a lower growth rate compared to other European countries which are catching up quickly with a 21% growth.

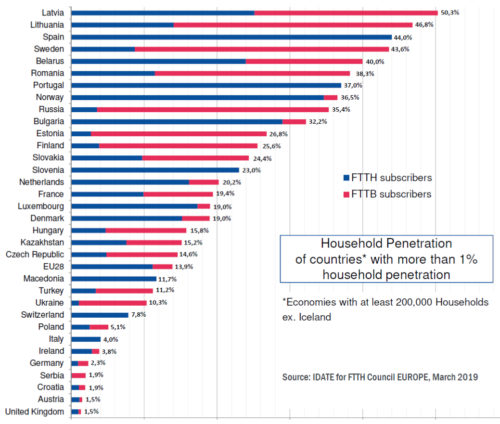

Latvia leading the ranking for the 3rd year in a row of European FTTH penetration

The deployment of both FTTH and FTTB networks has increased significantly. By September 2018 it is estimated that the coverage(2) of FTTH/B reached 46,4% in the EU39 and 36,4% in EU28(3). This shows a clear upward trend from September 2015 where the estimated coverage rate in the region was 39% in the EU39 and 27,2% in the EU28.

This year(4), the country adding the most subscribers is European. Spain added 1.858.743 new FTTH/B subscribers, France comes second with an addition of 1.480.220 new FTTH/B subscriptions, while Russia saw its FTTH/B subscriber base increase with 1.256.000 new FTTH/B customers. Other countries also experienced notable increases such as Czechia with 523.950 new subscribers and Italy with 449.637 new subscribers. Italy saw an outstanding growth in the number of homes passed, from 4.398.435 in September 2017 to 6.295.000 in September 2018 for a total increase of 43.12%.

The take-up rate elevated to 37.4% for EU39 from 34.8% the previous year with a take-up rate for EU28 (38.2%) surpassing the EU39 rate for the first time. Countries like Andorra, Belarus, Belgium, Latvia, Netherlands and Romania experience a take-up rate surpassing 50%.

It is interesting to note that fibre technologies have evolved the last years; by September 2018, we observe a predominance of FTTH architecture over FTTB (56% vs 44%).

In the European region, alternative players are the most involved in FTTH/B expansion, with a contribution of around 55% from the FTTH/B total players. We also see that governments and local authorities are getting more involved in fibre projects, either directly, by signing agreements with telecom players, or via public funds. It is also worth noting that incumbents in some countries have started to modify their strategy in order to deploy FTTH solutions, instead of continuing the development of legacy copper-based or cable-based networks.

Commenting on the report, Ronan Kelly, President of the FTTH Council said: “these new figures show a momentum that is accelerating over the last few years. Full fibre is the way forward and the results of the Market Panorama provide compelling evidence of this. Fibre expansion is booming in many countries and today more consumers are aware of the benefits of fibre. Our job is not done, however, there is still a long way to go until every citizen and business has access to the benefits of full fibre in Europe.”

Latvia remains a leader in FTTH/B, championing the ranking for another year followed by Lithuania (46.9%). Spain makes a huge stride from 33.9% to 44% and comes in 3 rd clinching a spot on the podium slightly ahead of Sweden at 43.6%.

UK joins the Global FTTH Ranking

This year, the United Kingdom enters the Global ranking, reaching a penetration rate of 1.3% and a take-up rate of 13.1%. FTTH/B subscriptions grew by 83% compared to September 2017 for a total of 369,250 subscribers, and its FTTH/B Homes passed by 22.8% reaching 2,817,000 homes passed.

UK regulator, Ofcom has played a major role in promoting investments in FTTH/B across the country. After reducing the prices of wholesale services from Openreach to encourage investments and competition in the market, Ofcom set out a plan to support full-fibre investment in July 2018. The plan follows the direction set in Ofcom’s 2016 Strategic Review of Digital Communications which is aimed at supporting the Government’s ambition of 15 million homes to have access to full-fibre broadband by 2025.

The Netherlands, country of the FTTH Conference 2019

In September 2018, the Netherlands counted 3,064,000 homes passed by FTTH/B for a total of 1,577,700 subscribers, a growth of 5% in homes passed and 16% in subscribers compared to the previous year. The fibre take-up was about 51.5% of the total homes passed by FTTH/B technology, which ranked Netherlands among the top countries in Europe.

FTTH market forecasts 2020 and 2025

This market forecasts are based on an individual analysis of 15 countries(5). While Russia is expected to continue leading the ranking for FTTH/B homes passed in 2020 and 2025, it is very interesting to note that the UK is likely to catch up to become 2 nd in the ranking in 2025, ahead of France and Spain. Estimates plan for around 187 million home passed for FTTH in 2025 in EU28 with fibre becoming closer to the end-user with FTTH accounting for 63.8% versus 36.2% for FTTB.

Finally, these forecasts highlight the role of public incentives towards fibre-based technologies to foster FTTH growth throughout Europe, which will also be positively impacted by copper switch-off.

We believe that the European Electronic Communications Code, which was recently adopted will boost even more the number of homes passed – if correctly implemented – by providing regulatory certainty and incentives to investors of all types and allowing for more actors to join the fibre league added Erzsébet Fitori, Director General of the FTTH Council Europe.

1. The EU 39 includes Andorra, Austria, Belarus, Belgium, Bulgaria, Croatia, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Kazakhstan, Latvia, Lithuania, Luxembourg, Malta, Macedonia, Netherlands, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine and United Kingdom

2. Coverage = Homes passed / Households

3. The EU 28 includes Austria, Belgium, Bulgaria, Croatia, Cyprus, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, United Kingdom

4. Between September 2017 and September 2018

5. Bulgaria, France, Germany, Italy, Kazakhstan, Netherlands, Poland, Portugal, Romania, Russia, Spain, Sweden, Turkey, Ukraine, UK

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally