Netflix streaming volume up 350% in 10 quarters

Thursday, September 25th, 2014

New Report Analyzes Netflix’s Growth and Assesses Future

Opportunities both Domestically and Internationally

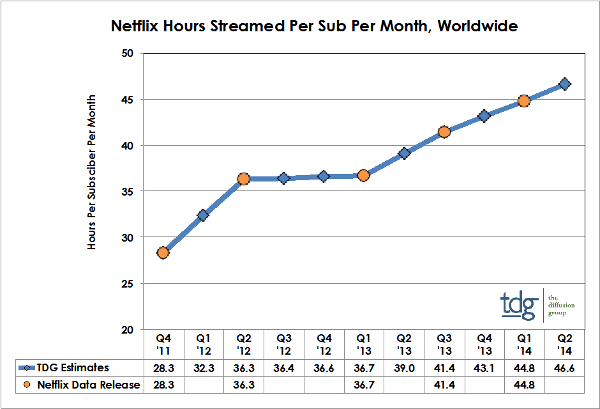

PLANO, TX — According to new research from The Diffusion Group (TDG), Netflix streaming has increased 350 percent during the last 10 quarters, growing from two billion hours in Q4-11 to seven billion hours as of Q2-14. Netflix 2014 – Domestic Dominance, International Escalation, presents TDG’s latest analysis of Netflix and examines subscriber growth and hours streamed, and offers domestic forecasts for both through 2022. The report also discusses Netflix’s new frontier, international service introductions.

As illustrated, total streaming among US Netflix subscribers rose from 1.8 billion hours in Q4-11 to 5.1 billion hours in Q2-14, almost tripling during this period. Total international streaming grew from 0.2 million hours in Q4-11 to 1.9 million hours in Q2-14, a ten-fold increase.

Although the rate of international streaming growth has outpaced that of domestic streaming, US consumption remains responsible for the majority of total worldwide streaming hours. In Q3-11, domestic Netflix subscribers represented 94% of the worldwide total. In Q2-14 the US share of total worldwide subscribers declined to 72%, a trend expected to continue as Netflix executes its international expansion strategy.

“When Netflix first launched in 1998 as an innovative DVD-by-mail subscription service it would have been difficult to imagine that, not only would it pass HBO to become the largest premium TV/movie subscription in the US, but that it would be ramping up a formidable international streaming business,” notes Bill Niemeyer, TDG Senior Adviser and author of the new report. Niemeyer says this is all the more remarkable given that Netflix launched its Internet streaming service only seven years ago, in 2007.

TDG’s new report, Netflix 2014 – Domestic Dominance, International Escalation, provides:

- A review of historical streaming subscription levels from Q3-11 to Q4-14;

- An examination of Netflix’s international TAM expansion market from 2010 to 2014;

- A comparison of Netflix subscription with leading premium TV networks including HBO, Showtime, and Starz, as well as with MVPD VOD;

- Estimates of Netflix US and international quarterly streaming usage from Q3-11 to Q4-14, both per-subscription and in total;

- Forecasts of Netflix US streaming subscriptions and use from 2013 to 2022 and comparisons with estimated 2013 annual US TV viewing; and

- Suggested strategies for Netflix, as well as those looking to compete with the company, including incumbent networks and operators, and native OTT firms.

TDG’s new report is now available for public purchase by visiting TDG’s website or by contacting our sales team at sales@tdgresearch.com.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally