Consumer spending on VR to hit $3.3 billion by 2020

Thursday, October 6th, 2016

Consumer Spending on Virtual Reality Entertainment to Hit $3.3 Billion by 2020, IHS Markit Says

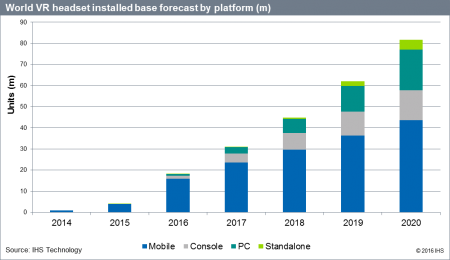

- Virtual Reality (VR) headset usage to jump from 4 million in 2015 to 81 million in 2020; Sony’s PlayStation VR will outsell Oculus Rift and HTC Vive in 2016

LONDON — Aggressive promotional activity from smartphone vendors and the launch of premium smartphone VR solutions, including Google’s Daydream View, will help drive the installed base of VR headsets from 4 million in 2015 to 81 million in 2020. That same year, consumer spending on VR headsets will reach $7.9 billion and spending on VR entertainment will hit $3.3 billion.

New analysis and forecasts on the VR market were released today by IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions, in a new report Virtual Reality Market Opportunity Report 2016.

“While the VR headset installed base will escalate significantly to 81 million by 2020, we predict that expensive, higher-end headsets will dominate content monetisation,” said Piers Harding-Rolls, director of games analysis at IHS Technology. “There will be a polarization of the VR market between lower volume premium VR headsets, which will have strong paid content conversion rates, and higher-volume cheaper smartphone VR headsets, which will monetise content at a lower rate.”

Market opportunity

“Smartphone VR headsets will represent the largest addressable market for VR content because of cheaper pricing. The smartphone VR base will be a major opportunity for VR content experimentation,” said Ian Fogg, senior director at IHS Technology. “Smartphone VR headsets’ share of the VR installed base will be 87 percent at the end of 2016.”

Consumer spending on VR headsets will be $1.6 billion in 2016, bolstered heavily by the launch of high-end headsets from Oculus, HTC and Sony. This will drive average sales price of all headsets to close to $85 from $26 in 2015. The average selling price is expected to climb sharply once again in 2017 to $191 as high-end headsets sell more, the IHS Technology report said.

Meanwhile, consumer spending on VR entertainment is forecast to hit $310 million in 2016, growing to $3.3 billion in 2020, as the high-end headsets gain more traction.

“A $3.3 billion VR entertainment market by 2020 will represent less than 1 percent of overall entertainment spending worldwide,” Harding-Rolls said. “There is certainly more to be done in terms of premium content for VR platforms and it will take time to deliver on the potential of the technology.”

Samsung’s Gear VR to lead in 2016; Google’s Daydream View to counter

IHS Technology forecasts Samsung’s Gear VR to have the largest installed base out of all the major branded headsets in 2016 with 5.4 million.

However, the launch of Google’s Daydream View – Google’s next generation smartphone VR headset – will slowly disrupt Samsung’s dominant market position in the smartphone VR market. While the high-price of Google’s Pixel phone means the 2016 impact will be small, IHS Technology forecasts that Google Daydream View will become the most popular headset for VR by 2019. Google will overtake Samsung’s Gear VR due to broad industry support, a compelling $79 price point and the delivery of a premium smartphone VR experience.

Sony’s PlayStation VR to outsell high-end competitors

IHS Technology forecasts Sony’s PlayStation VR will outsell Oculus Rift and HTC Vive combined in 2016, but will also be supply-constrained as the company plays it safe on stock inventory.

In 2016, IHS Technology forecasts PlayStation VR will sell 1.4 million headsets and will generate $134 million in spending on VR entertainment, with the PC-based headsets generating $69 million.

Crucially, PlayStation VR comes to market at a cheaper price point than the PC competition and is addressing a much larger audience of PlayStation 4 consoles than VR-ready PCs. The installed base of PS4s will reach 53 million by the end of 2016, compared to 16 million VR-ready consumer PCs.

“Sony is well positioned to build an early lead in the high-end VR headset race because of its large addressable market of 53 million PS4s by the end of 2016, its lower total cost of ownership compared to the PC VR companies and its ability to get big franchises into VR,” Harding-Rolls said. “With VR content and users strongly aligned with the games market, Sony already has in place many of the components necessary to deliver to this new VR entertainment segment at the expense of its competitors.”

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally