Flat Panel Display revenues to grow in 2017

Tuesday, November 22nd, 2016

Flat Panel Display Revenues Forecast to Increase in 2017, IHS Markit Says

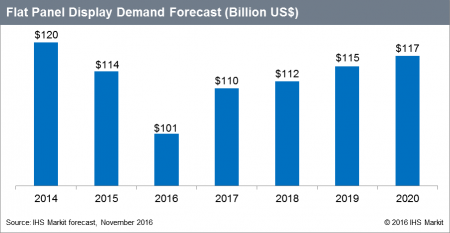

LONDON — After two consecutive years of decline, global flat panel display revenue is expected to grow by 9.3 percent year-over-year in 2017 to $110 billion, according to IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

“While it would be unrealistic to expect an increase in unit demand next year in view of an overall sluggish global economy outlook, market revenue for flat panel display can be expected to grow significantly following a rebound in panel prices along with an increased demand for premium display products,” said Ricky Park, director of Display Research at IHS Markit.

According to the latest IHS Markit Display Long-Term Demand Forecast Tracker report, the year-on-year growth rate of the flat panel display market by unit demand is projected to remain low at 0.3 percent in 2017. In contrast, display area demand is expected to grow 6.6 percent, and market revenue is expected to grow 9.3 percent over the same period.

The main factor driving revenue growth is the rapid rebound in panel prices in 2016. The price of 32-inch open cell that had dropped 41 percent in 2015 due to oversupply in the second half of the year has started to rebound in April before increasing 36 percent in October compared to December last year.

The rebound in panel prices is attributed to supply-related issues such as restructuring of liquid crystal display (LCD) display fabs, production halts, and deteriorating yields from the maximization of production efficiency. Price increases were not just restricted to TV panels, but also smartphone, desktop monitor, and mobile PC-use panels, all of which turned upward from the second quarter.

Revenue growth is also being pushed by an increased supply of premium products that has raised the overall ASP (average selling price). The demand switch towards premium products, include consumer preferences for larger-size displays for TVs, desktop monitors, and tablets and for high-definition panels, including ultra-high definition displays. There was also a demand switch for active-matrix organic light-emitting diode (AMOLED) panels in smartphones, and for oxide and low-temperature poly silicon panels in mobile PCs and desktop monitors.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally