Big-3 SVOD players to triple original content spending by 2022

Tuesday, January 30th, 2018

TDG: Big-3 SVOD Original Content Spending to Triple by 2022

- New TDG Report Examines the Role of Original Content in Driving Viewer Acquisition & Retention, and the 5-Year Content Strategies of Netflix, Hulu, and Amazon Prime Video

PLANO, Texas — The Big-3 SVOD players – Netflix, Hulu, and Amazon Prime Video – will shift an increasing percentage of their content budgets from licensed content to originals. By 2022, the amount invested in originals will triple to $10 billion annually — this according to a new report published by The Diffusion Group.

“The Big-3 SVOD players own 60% of TV streaming time,” notes Brad Schlachter, TDG senior advisor and author of the new report. “And they are looking to maintain if not grow this share by creating compelling originals that serve both to attract new users and retain existing subscribers even as subscription rates increase.”

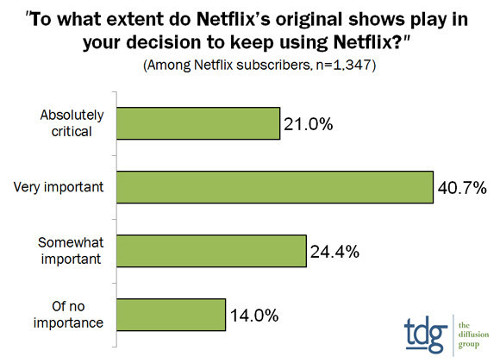

Just how important are originals to retaining subscribers? According to TDG’s original research, extremely important.

Among Netflix subscribers, 21% rank originals as “absolutely critical” in their decision to keep using Netflix, while 41% rank them as “very important.” “The data is unequivocal,” says Schlachter, “though it varies among the Big-3 SVOD providers.”

Much like HBO decades ago, the Big-3 now have a much better understanding of the limits of licensed content and the benefits of a viable slate of originals. “Of course, not all originals find an audience or generate a huge buzz,” says Schlachter. “But when they do, it can change the fortunes of a company. Just look at what The Handmaid’s Tale did for Hulu, or what House of Cards did for Netflix.”

As studios like Disney pull their most compelling content from Big-3 SVOD libraries, the necessity of a strong slate of originals becomes all the more obvious. But the Big-3 are not the only players eyeing a larger slice of the originals on-demand streaming market. In fact, companies as diverse as Facebook and Apple are investing in original TV-quality programming to distribute directly to consumers. Certainly Disney’s initiatives to launch its own D2C ‘channels’ will make it a potent competitor in this space.

Big-3 SVOD and the Original Content Arms Race – Analysis & Forecasts features TDG’s analysis of the forces driving both current and future content budgets among Netflix, Hulu, and Amazon Prime Video and breaks out licensed vs. original content thru 2022. It also examines the conditions that gave rise to the current arms race, as well as evaluates the growing slate of competitors entering (or soon to enter) this marketplace.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally