FreeWheel releases Q1 2019 Video Marketplace report

Tuesday, July 23rd, 2019

FreeWheel report reveals premium video growing ever stronger as it becomes more addressable and data-driven

- Total ad views up 13% in first quarter of 2019, with live ad views rising 78% year-over-year

LONDON, UK — FreeWheel, a Comcast company and the industry’s most complete advertising management solution, has announced the launch of its Q1 2019 Video Marketplace Report, which shows a rise in targeted and addressable advertising as publishers and marketers increasingly look to efficiently reach audiences.

In Europe, there is a focus on data-driven targeting and automation as a growing number of publishers adopt an audience-first approach. Total ad views grew 13%, but live ad views increased by 78% year-over-year. Audience targeted campaigns also grew above the market growth rate, rising 56% as publishers increase the use of data to make premium video addressable.

Programmatic has experienced significant growth, increasing 31% year-over-year – four times the rate of direct sales – as publishers strive to automate and drive efficiencies in the buying process. However, premium video still makes less use of programmatic channels than the wider digital video ecosystem, where 74.1% of digital video is traded programmatically.

Thomas Bremond, General Manager, International, FreeWheel, commented: “Premium video displayed strong ad view growth, particularly in audience targeted campaigns. Data-driven advertising is changing the way advertisers and publishers approach premium video, as a growing number adopt an audience first-approach. With continued improvements and advancements to the tech stack across multiple endpoints the outlook for premium video looks very promising through the rest of the year and beyond.”

The enabling of premium video inventory across Set-top Box Video on Demand (STB) and Connected TV (CTV) once again demonstrated the power of the big screen, together accounting for the largest share of ad views at 45%. There is also an ongoing drive towards shorter ad breaks. Total ad break durations were around 94 seconds and there was an average of four ads per midroll break, with 42% of all midroll breaks containing two ads or less.

Other findings from the report included:

- The addition of more live inventory is furthering the scale of premium video with the share of live ad views now twice as large as that of Q1 2018.

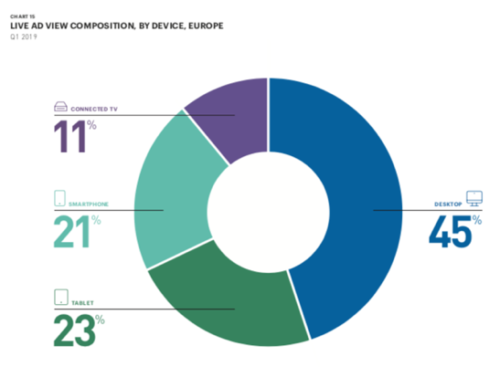

- Desktop leads the devices used to view live premium video with over 40% of live ad views.

- 25% of campaigns are audience targeted

The FreeWheel Video Marketplace Report is released quarterly and highlights the changing dynamics of how enterprise-class content owners and distributors are monetising premium digital video content. The data set used for this report is one of the largest available on the usage and monetisation of professional, rights-managed video content worldwide, and is based on census-level advertising data collected through the FreeWheel platform.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally