U.S. sees largest first quarter multichannel subscriptions decline to-date

Friday, May 15th, 2020

Industry sees largest first quarter multichannel subscriptions decline to-date; online-only households expected to dominate growth in outlook

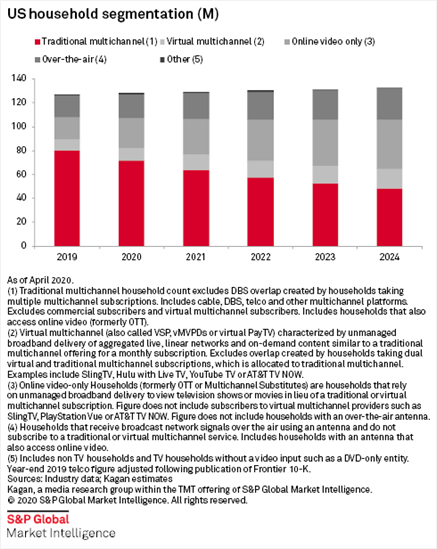

MONTEREY, CA — Initial speculation that TV-hungry, isolated viewers would at least temporarily stem cord cutting in the U.S. was dispelled with the industry’s largest first quarter decline for traditional multichannel subscriptions (subs). At two million, it was both the biggest absolute and relative quarterly drop to-date.

Kagan, a media research group within S&P Global Market Intelligence, estimates it was the first quarterly decline for virtual multichannel alternatives. The broadband-delivered services collectively lost 261,000 subs or 2.8% to finish the quarter with 9.2 million subs. Gains from Hulu with Live TV and YouTube TV were erased by the declines from Sling TV and AT&T TV Now as well as Sony’s decision to shutter PlayStation Vue in January.

In comparison, subscriptions to traditional cable, direct broadcast satellite (DBS) and telecommunications (telco) video services dropped 2.4% in the quarter.

The difficult start to the year underpins Kagan’s updated forecast for video market share in the U.S. The revised outlook found that mounting unemployment and the COVID-19 economic downturn only added to the already pervasive cord cutting forces. This fueled revised expectations for online-only households to surpass combined traditional and virtual multichannel subscribers in the projections.

Additional takeaways from Kagan’s Updated U.S. Video Forecast:

- Home isolation should have stemmed multichannel defections, but the cruel irony of the interruption in programming and ensuing economic turmoil is expected to blunt the benefits. We forecast an 11% drop in traditional multichannel subscriptions in 2020, and penetrations of less than 56% at the end of the year.

- Virtual services have narrowed their cord cutter appeal and are expected to account for less than 10% of occupied households to reach nearly 11 million by year-end 2020.

- The upward momentum of online-only households satisfying entertainment needs solely through a combination of free and subscription streaming services is expected to accelerate to 24.7 million by the end of 2020, accounting for more than 19% of occupied households.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally