U.S. video losses slow to 1.5 million in 2Q 2021

Tuesday, August 24th, 2021U.S. video losses slow to 1.5 million alongside virtual service growth

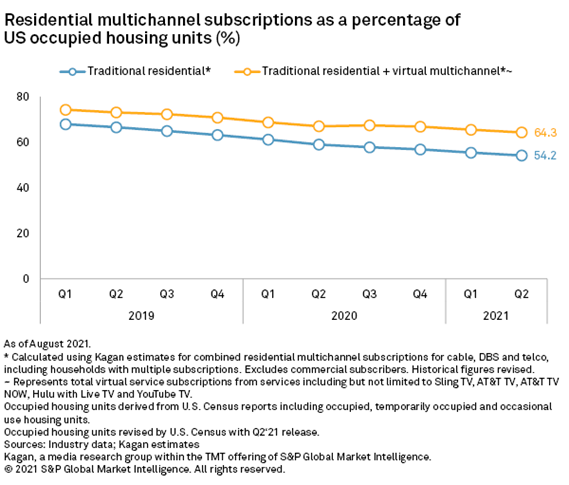

NEW YORK — The quarterly variations in the pace of U.S. traditional multichannel erosion offered slight improvement in the second quarter of 2021 without fundamentally altering the longer-term trajectory, according to Kagan, a media research group within S&P Global Market Intelligence. Losses to cable, telco and satellite video services slowed from the year-ago period to 1.5 million and were accompanied by improvements to the comparisons for the first six months and trailing 12-month periods from 2020.

Kagan’s latest report found that continued sluggish virtual multichannel growth hampered progress in maintaining the number of subscriptions to a package of live linear network and on-demand content represented by the combined traditional and virtual multichannel segments. The combined virtual and traditional multichannel households accounted for 64.3% of occupied households at 83.1 million residential subscriptions.

Additional takeaways from Kagan’s Q2 2021 U.S. multichannel subscribers report:

- Virtual multichannel eked out a 0.7% sequential uptick in subscribers, passing 13 million customers. The segment gained 2.7 million subscribers in the 12 months ended June 30, 2021.

- Cable losses slowed sequentially. For the six-month period ended June 30, however, 2021 shows the sector’s largest decline on record, topping the previous trough logged in 2020 by nearly 10%.

- Satellite multichannel logged its smallest quarterly net losses since the second quarter of 2018, but the segment remains on a seemingly inexorable downward trajectory, ending the period with an estimated 20.5 million subscribers, down 39% from its first-quarter 2014 peak.

- Telco video subs slumped to 7.3 million. Overall losses were driven by the estimated 7.5% sequential decline in AT&T U-verse subscribers, while Verizon Fios notched a more moderate 1.6% slide, a pace more in line with the cable sector.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally