U.S. pay TV suffers historic cord-cutting

Tuesday, September 22nd, 2020Pay TV Suffers Historic Cord-Cutting

- More than 6 million US households will cut cable this year

NEW YORK, NY — While pandemic-driven lockdowns may have benefited certain forms of media, the traditional pay TV industry is not one of them. In fact, cable, satellite, and telecom TV providers will lose the most subscribers ever.

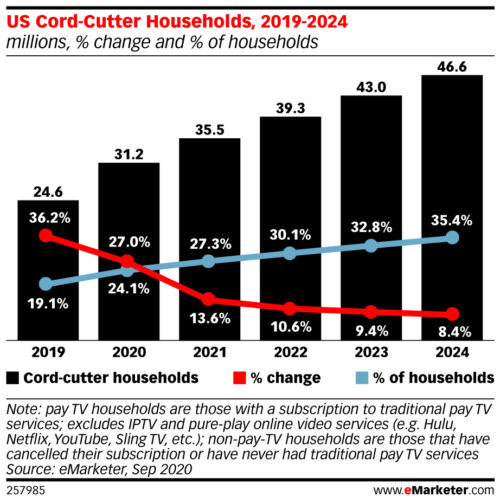

By the end of this year, 31.2 million US households will have cut the cable TV cord in aggregate. And 6.6 million households will cancel their pay TV subscriptions. By 2024, more than one-third of US households will have cut the pay TV cord.

“Consumers are choosing to cut the cord because of high prices, especially compared with streaming alternatives,” said eMarketer forecasting analyst at Insider Intelligence Eric Haggstrom. “The loss of live sports in H1 2020 contributed to further declines. While sports have returned, people will not return to their old cable or satellite plans.”

That leaves 77.6 million US households with cable, satellite, or telecom TV packages, down 7.5% year-over-year, the biggest such drop ever. Furthermore, that total is down 22.8% from pay TV’s peak in 2014. By the end of 2024, fewer than half of US households will subscribe to a pay TV service.

“As pay TV subscriber losses accumulate, cable providers have been focusing on their internet services, which are more profitable and have benefited from the consumer shift to streaming video,” Haggstrom said.

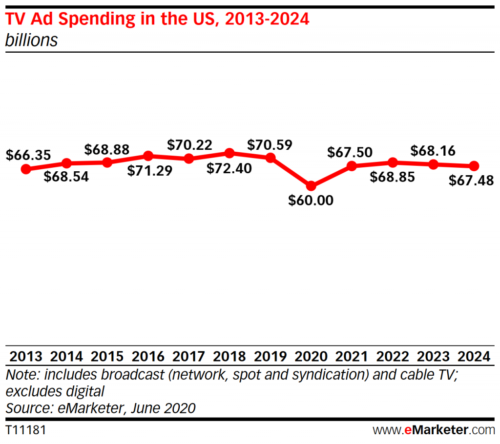

The loss of viewers is coupled with a major hit to traditional TV ad spending. Total spend will drop 15.0% this year to $60.00 billion, the lowest the industry has seen since 2011. And while it will rebound some next year, TV ad spending will remain below pre-pandemic levels through at least 2024.

“While TV ad spending will rebound in 2021 with the broader economy, it will never return to pre-pandemic levels,” Haggstrom said. “Given trends in cord-cutting, audience erosion, and growth in streaming video, more ad dollars will shift from TV to digital video in the future.”

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally