Malaysia SVOD household penetration to reach 41% in 2027

Wednesday, June 21st, 2023

Malaysia SVoD household penetration to reach 41% in 2027, forecasts GlobalData

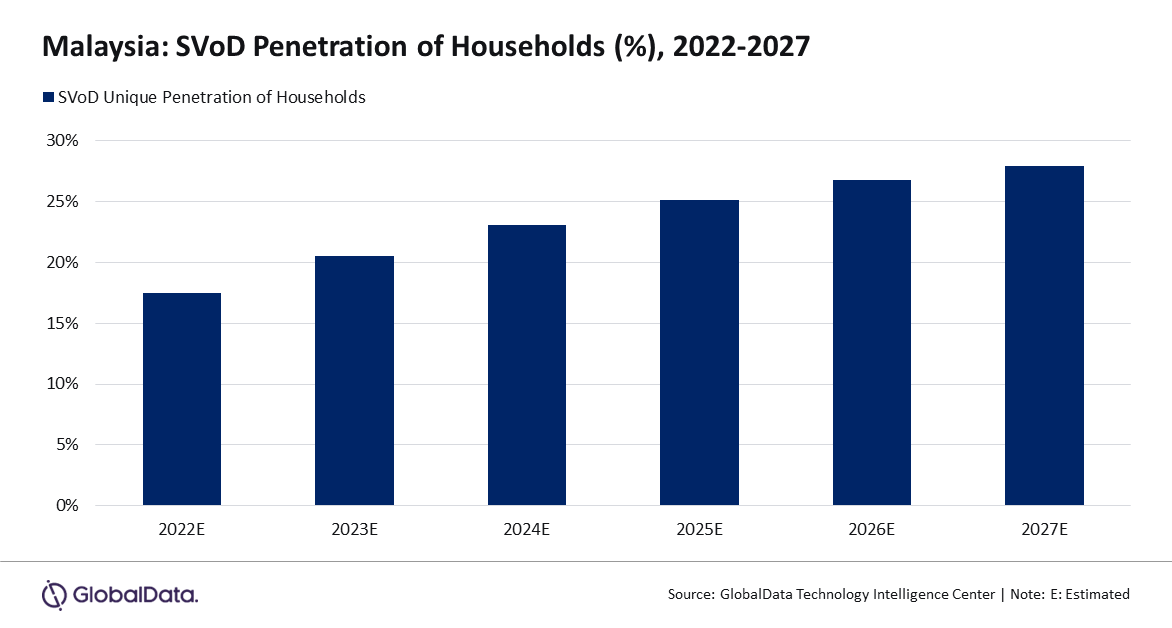

The household penetration of subscription video on demand (SVoD) services in Malaysia is expected to increase from 22% in 2022 to 41% in 2027, driven by the increasing consumer preference towards SVoD platforms as broadband services continue to improve in the country, forecasts GlobalData, a leading data and analytics company.

GlobalData’s Malaysia Subscription Video on Demand (SVoD) Forecast (Q2 2023) reveals that SVoD subscriptions in the country will increase at a CAGR of 15% over the forecast period 2022-2027, in line with the accelerated cord cutting trend among the traditional pay-TV viewers and their increasing migration towards on-demand video services. The competitive pricing strategies adopted by OTT service providers and their investments in premium local content will also drive the growth in SVoD subscriber base over the forecast period.

Kantipudi Pradeepthi, Telecom Analyst at GlobalData, says: “Increasing coverage and availability of broadband services, and promotional multi-play service bundle plans with free subscriptions to OTT platforms will additionally lend traction to the SVoD service adoption in the country.”

Netflix held the largest share in Malaysia’s total SVoD subscriptions in 2022 and will continue to lead through 2027. Heavy investments in high quality regional content, and affordable mobile-only plans offered at $4 per month will help the company maintain its leadership in the market over the forecast period.

Pradeepthi concludes: “Malaysia is a price-sensitive market and hence many streaming players are adopting innovative pricing strategies to add new subscribers. iFlix and Viu, for instance, allow their basic plan subscribers to watch some content for free in exchange for viewing advertisements while the ad-free shows and movies are usually locked for premium subscription plans. Operators are also differentiating their services through their content offerings. While iFlix and Viu offer a wide range of Asian and local content, Netflix brings Hollywood blockbusters and exclusive shows to viewers.”

Links: GlobalData

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally