Telecom and pay-TV revenue in Hong Kong to grow at 1.1% CAGR

Wednesday, November 29th, 2023

Telecom and pay-TV services revenue in Hong Kong to increase at 1.1% CAGR over 2022-2027, forecasts GlobalData

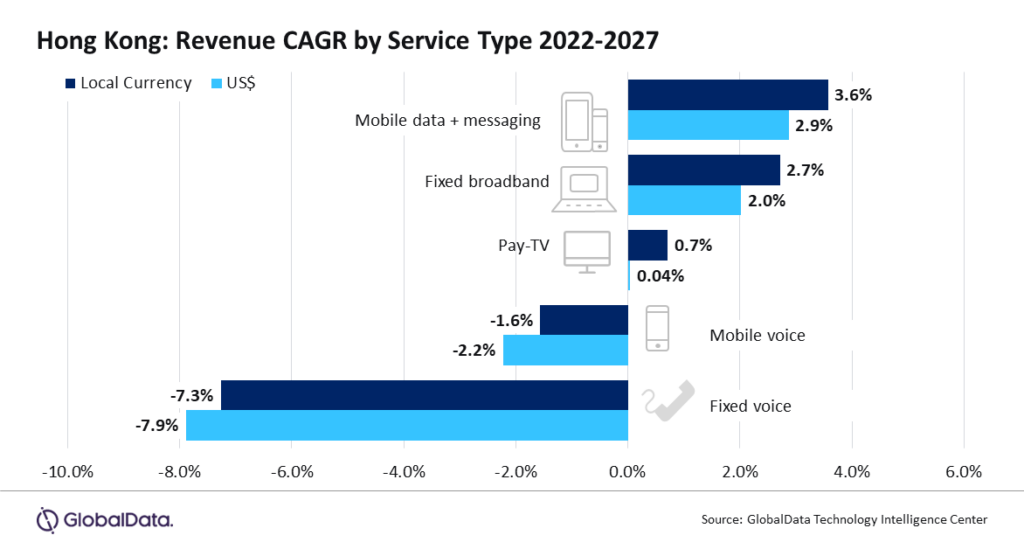

The total telecom and pay-TV services revenue in Hong Kong is expected to increase at a compound annual growth rate (CAGR) of 1.1% from $5.8 billion in 2022 to $6.1 billion in 2027, mainly supported by the mobile data and fixed broadband segments, forecasts GlobalData, a leading data and analytics company.

GlobalData’s Hong Kong Telecom Operators Country Intelligence Report reveals that mobile voice service revenue will decline during the forecast period, due to the steady drop in mobile voice service ARPU with users increasingly shifting to OTT communication platforms.

Mobile data service revenues, on the other hand, will increase at a CAGR of 4.1% over the forecast period, driven by the steady rise in smartphone adoption, growing mobile internet subscriptions, increasing consumption of mobile data services, and rising adoption of higher ARPU 5G services.

Sarwat Zeeshan, Telecom Analyst at GlobalData, says: “4G services accounted for a majority share of the overall mobile subscriptions in 2022. 5G subscriptions, however, will increase at a rapid pace and surpass 4G’s share of subscriptions in 2025, driven by the rising demand and growing availability of 5G services with operators offering promotional 5G service plans with greater data volumes for high-bandwidth applications like video streaming and mobile gaming.”

In June 2023, the country’s telecom regulator, the Office of the Communications Authority (OFCA) opened a public consultation for its proposed allotment of 400MHz in the 6/7GHz band for mobile services, with a focus on 5G. This initiative will further help in 5G network expansion and increased 5G service adoption in the country.

In the fixed communication services segment, fixed voice service revenue will decline over the forecast period, due to steady losses in circuit-switched subscriptions and declining fixed voice service ARPU. Fixed broadband service revenues, on the other hand, will increase at a CAGR of 2% over the 2022-2027 period, in line with the steady rise in fixed broadband subscriptions, particularly over fiber access lines.

Zeeshan adds: “Growing demand for, and increasing availability of higher-speed fiber broadband connectivity on the back of initiatives by the regulator to expand fiber network infrastructure across the country will drive steady rise in the adoption of fiber broadband services over the forecast period. For instance, in May 2023, OFCA extended its subsidy schemes for fixed network operators (FNOs) to support the deployment of fiber-optic networks in remote and underserved areas.”

Out of planned 235 villages across the nine districts in New Territories and on outlying islands, FNOs completed the fiber network roll out in 120 villages as of May 2023 and plan to expand network to the remaining villages by 2026.

Pay-TV service revenues in the country will increase marginally over the forecast period, thanks to the continued rise in IPTV subscriptions. However, the demand for traditional pay-TV services will continue to decline due to the growing preference for OTT-based video services.

Zeeshan concludes: “China Mobile Hong Kong (CMHK) and PCCW will remain the leading players in the mobile services market through the forecast period. Both operators will stand to gain from their strong focus on 5G network expansion and modernization efforts. PCCW and China Mobile have already achieved nationwide 5G coverage exceeding 90%, which serves as a significant advantage. In the fixed communications market, PCCW will lead both fixed voice and fixed broadband segments by subscriber share through to 2027. The telco’s leading position in the fixed broadband segment is supported by its growing share in the FTTH service segment on the back of fiber network expansions and its focus on offering promotional tariff plans.”

Links: GlobalData

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally