AR/VR headsets surged during Holiday Season 2023

Tuesday, March 5th, 2024

AR/VR Headsets Surged During the Holiday Season 2023, According to IDC

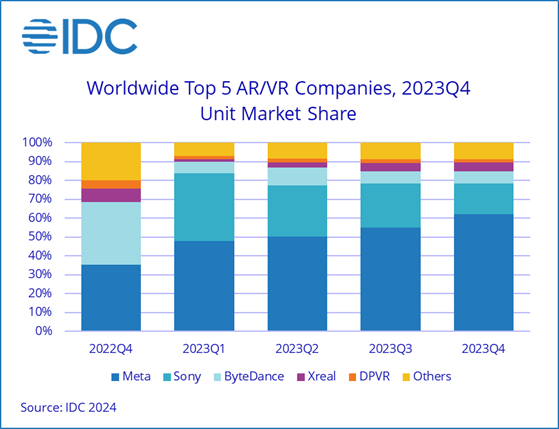

NEEDHAM, Mass. — As macroeconomic pressures eased and new products launched, the global market for augmented reality and virtual reality (AR/VR) headsets grew 130.4% year over year during the fourth quarter of 2023 (4Q23), according to new data from the International Data Corporation (IDC) Worldwide Quarterly Augmented and Virtual Reality Headset Tracker.

“After losing share to Pico and later Sony a few quarters ago, Meta’s share has been on a steady climb thanks to its ongoing subsidization of hardware and the launch of the Quest 3,” said Jitesh Ubrani, research manager, Mobility and Consumer Device Trackers at IDC. “While Apple’s entrance as well as newer devices from other vendors in this space certainly adds pressure, Meta’s lead will likely remain unchallenged during the year as the company’s low-cost, high-volume strategy will separate it from the rest of the pack.”

For the full year of 2023, shipments of AR/VR headsets were down 23.5% from 2022 levels. Macroeconomic uncertainty put downward pressure on demand during the first half of the year and most companies relied on legacy products that had already been available for at least a year, leading to double-digit declines. It was not until key regions began seeing economic recovery and new products were launched that the market started to rebound, but not enough to offset the first half declines.

“2023 began in much the same way that 2022 ended: with a series of significant year-over-year declines,” noted Ramon T. Llamas, research director with IDC’s Augmented and Virtual Reality program. “This reflected the situation in many other markets, and AR/VR was not immune to them. However, this did allow companies throughout the ecosystem to further hone their experiences with mixed reality, artificial intelligence, and display technologies to prepare for a better 2024.”

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

Links: IDC

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally