China's DTV STB Market Has Explosive Growth

Tuesday, September 16th, 2008BEIJING — CCID Consulting, China’s leading research, consulting and IT outsourcing service provider, and the first Chinese consulting firm listed in Hong Kong (Hong Kong Stock Exchange: HK08235), recently released its article on China’s DTV STB market.

In 2008H1, China’s STB market has rapid development. CCID Consulting’s data shows that the sales volume of China’s STB market reached 11.69 million sets in 2008H1, up 110.1% year-on-year.

In 2008H1, the arrival of the Olympic Games brings abundant orders for enterprises. The sales revenue in 2008H1 reaches 4.181 billion Yuan, up 73.6% year-on-year. The sales volume of high-end STBs increases, such as HD, which postpones STBs’ price fall. STBs’ sales revenue grows in step with sales volume.

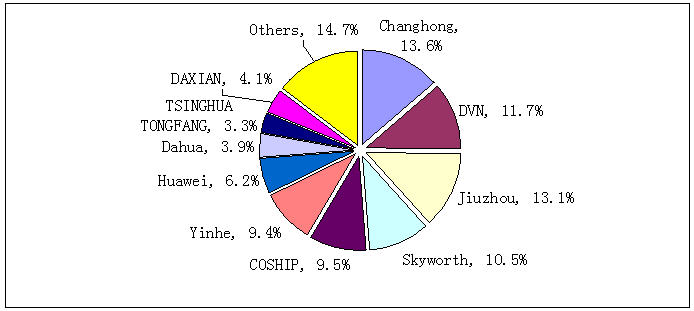

Jiuzhou has excellent presentation in domestic and international market in 2008Q2. Changhong has stable presentation in 2008Q2, which ranks first with market share of 13.6%. DVN is the top three, with a market share of 11.7%; Skyworth ranks fourth, market share is 10.5%. With sales volume’s rapid growth, besides TOP10, other brands also have preferable presentation, improving their market shares significantly.

Figure 1: Brand Sales Structure of China’s DTV STB Market in 2008H1

Source: CCID Consulting, July 2008

In 2008H1, Beijing, Shanghai, Shenzhen and Tianjin launched digital terrestrial television; Qinhuangdao, Qingdao, Shenyang and Guangzhou will start digital terrestrial television, but terrestrial STB which faces ordinary residents has not appeared. Some brands have launched digital terrestrial television, such as TOSHIBA, which are sold in Beijing and Qingdao. Integrated machine integrates STB’s functions into television. Integrated sale will affect the sales volume of STB. As for satellite DTV, despite the successful launch of Chinasat 9 satellite on June 9, satellite’s live broadcasting policy and terrestrial carriers have not been fixed. Sales volume of satellite STB remains stagnant; in 2008H1, China Telecom pays more attention to the development of IPTV and enlarges investment in purchasing STB.

Table 1: Structure Change of China’s DTV STB Sales Volume in 2008H1

| Unit: 10,000 Sets | H1 2007 | % Share | H1 2008 | % Share | GR Y/Y |

|---|---|---|---|---|---|

| Cable | 512.8 | 92.2% | 1,112.8 | 95.2% | 117.0% |

| Terrestrial | 11.9 | 2.1% | 14.0 | 1.2% | 17.6% |

| Satellite | 4.6 | 0.8% | 6.3 | 0.5% | 37.0% |

| IP | 27.1 | 4.9% | 35.8 | 3.1% | 32.1% |

| Total | 556.4 | 100.0% | 1,168.9 | 100.0% | 110.1% |

Source: CCID Consulting, July 2008

Note: In terrestrial DTV STB data, onboard mobile data include DTV unity machine; satellite users doesn’t include illegal users

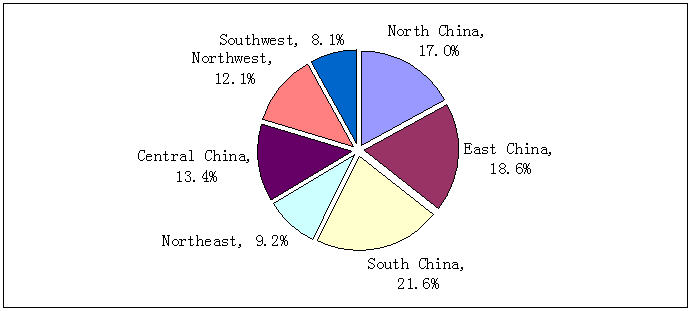

China’s STBs’ sales regions are focused in North China, East China and South China, which correlate with advanced economies, large population bases and the State Administration of Radio Film and Television’s layout. In 2008H1, cable DTV users in Guangdong, Jiangsu, Guangxi and Zhejiang increase rapidly; south China and east China has the largest sales volume.

Figure 2: Regional Markets’ Sales Volume Structure of China’s DTV STB Market in 2008H1

In 2008H2, with the approach of Olympic Games, DTV will enter rapid development period in July, but in August and September, affected by Olympic Games, CCID Consulting forecasts the sales volume of STB will decrease and 2008H2 will maintain a similar market size as of 2008H1.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally