iSuppli Trims 2010 Semiconductor Forecast Amid Softening Demand, Rising Stockpiles

Thursday, September 30th, 2010

With consumer demand slowing and inventories rising, the market research firm iSuppli Corp. is trimming its 2010 semiconductor revenue forecast to 32 percent, down from its previous outlook of 35.1 percent.

Global semiconductor sales now are expected to amount to $302 billion in 2010, up from $228 billion in 2009. Despite the reduced outlook, 2010 still will be a year of impressive growth and record-setting revenue for the semiconductor industry. Revenue in 2010 will rise by $73 billion compared to 2009 and be almost $28 billion higher than 2007, the previous last peak year for semiconductor revenue, according to iSuppli’s semiconductor industry analysis.

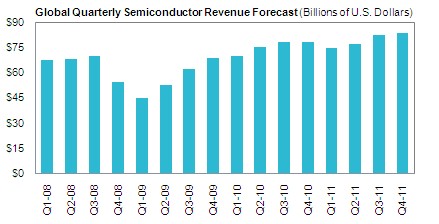

iSuppli now expects that revenue in the fourth quarter will decline by 0.3 percent compared to the third quarter, the first sequential decrease since the market collapse in the fourth quarter of 2008 and first quarter of 2009.

“There has been a significant slowdown in the second half in consumer demand for some electronic devices, including PCs,” noted Dale Ford, senior vice president at iSuppli. “Meanwhile, inventories have been building throughout the semiconductor supply chain. These factors will conspire to cause a small sequential decline in semiconductor revenue in the fourth quarter.”

Largely because of this fourth-quarter decline, global semiconductor revenue in the second half of 2010 will rise by 7.8 percent compared to the first half of the year. This is down from 10.7 percent growth in the first half of 2010 compared to the second half of 2009.

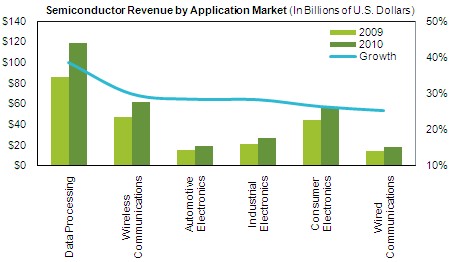

The leading electronic equipment market driving demand for semiconductors in 2010 will be the data processing area, a category dominated by PCs. With shipments of mobile PCs–including tablets–continuing to soar in 2010, semiconductor sales to this area will rise by 38.6 percent.

The second-strongest growth area will be wireless communications, fueled by booming demand for smart phones. Global semiconductor sales to the wireless communications area will rise by 30 percent in 2010.

Even the lowest-growth markets are expected to generate impressive semiconductor consumption in 2010. Wired communications and consumer electronics will drive semiconductor revenue growth of 25.4 percent and 26.5 percent, respectively, in 2010.

In terms of specific semiconductor products, the hottest items in 2010 will be DRAM, voltage regulators, LEDs, Programmable Logic Devices (PLDs) and data converters. Revenue for each of these products is projected to grow by more than 43 percent in 2010. DRAM will lead the group with 87 percent growth on the strength of the soaring PC market.

While the industry outlook remains cloudy and revenue will contract in the fourth quarter, iSuppli does not believe this signals the start of a significant downturn in the global semiconductor market.

“Unstable economic conditions and worrisome market reports continue to create an environment of poor visibility and ongoing uncertainty in the electronics industry,” Ford said. “This has led to frequently expressed concerns regarding a potential double-dip downturn in both the overall economy and in the electronics and semiconductor industries. However, based on its most recent analysis of the electronics supply chain, iSuppli expects the chip business to experience a soft landing in 2011 and not to suffer the kind of dramatic downturn seen in 2009.”

Global semiconductor revenue in 2011 will rise by 5.1 percent, iSuppli predicts.

Sequential quarterly growth in 2011 is projected to follow a more normal seasonal pattern compared to 2010, with declining revenue in the first quarter followed by improving sales that will reach a peak in the third quarter. The long-term growth expectation is for average annual growth of slightly more than 4 percent between 2010 and 2014.

More: Semiconductor Sales Projected to Avoid the ‘Double Dip’ Scenario

Latest News

- Larger-sized TVs to drive 8% growth in display area demand

- DASH Industry Forum (DASH-IF) becomes part of the SVTA

- Sky Stream to launch in Germany on July 31st

- Bitcentral ViewNexa integrates Pixalate Analytics

- Canal+ could be listed on the London Stock Exchange

- OKAST and Bouygues Telecom launch app for tourists in France