Defying Cord Cutting Craze, European Union Cable Market Expands in 2010

Wednesday, September 7th, 2011

Despite the rising specter of cord cutting, the European cable market continued to expand in 2010, with revenue throughout the E.U. rising by nearly 8 percent for the year on the strength of double-digit growth in digital television, broadband and telephony subscribers, according to the new IHS Screen Digest European Broadband Cable 2011 Report from information and analysis provider IHS (NYSE: IHS).

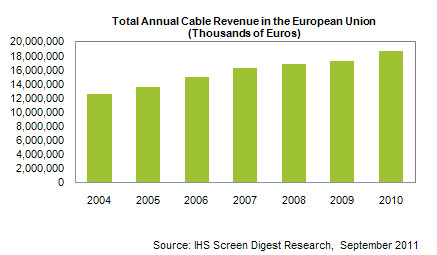

Total European Union cable revenue in 2010, including television, telephony and Internet, amounted to €18.7 billion, up 7.9 percent from €17.3 billion in 2009, as presented in the figure below. Growth was propelled by several factors, including a 15.8 percent increase in digital cable subscribers, a 10.8 percent rise in telephony customers and a 10.5 percent boost in Internet users. These strong results caused total E.U. cable revenue generating users–i.e. the number of individual service subscriber contracts–to rise above the 100 million level for the first time in 2010, reaching 101.1 million, up 3.2 percent from 97.9 million in 2009.

The figures show cable’s contributions to the ‘Digital Agenda,’ the ambitious European policy strategy to achieve concrete results in the global information society with a tight focus on high-speed broadband rollout. Cable Europe, the trade association representing leading European cable operators, greeted the numbers with a reminder of the importance in ongoing investments in fiber-rich, high-speed networks.

“Cable is a capital-intensive business but these numbers prove unequivocally that our investments were made in the right places at the right time,” said, Caroline Van Weede, Cable Europe Managing Director. “Across Europe we are seeing healthy growth in our key metrics, with cable operators increasingly coming to be seen be as value added service providers rather than utilities, as they may have done in the past.”

The continued expansion shows the European cable market is resisting the impact of the trend of consumers cancelling their traditional pay television services and turning to Internet-based alternatives, a rising phenomenon known as “cord cutting.”

“Cord cutting is having a major impact on the global cable market–particularly in the United States, where it is starting to cause a decline in subscribers,” said Guy Bisson, research director, television, for IHS. “However, the 2010 results for the European Union show that cord cutting doesn’t mean the end of the world. Strong increases in E.U. cable Internet and telephony subscribers are more than compensating for increasing competition in the cable television business.”

Consolidation Back on the Agenda

Consolidation was a major trend for the European cable business in 2010, with Liberty

Global back in full swing as a consolidating force in the industry. Its main focus during the year was Germany, a market that seems truly to have reached a turning point in terms of development of pay TV business models on cable and transition to digital.

But while there were a number of large deals in Western Europe–including Stofa in Denmark, Aster in Poland, Finland’s Welho and more recently, Sweden’s Com Hem–it was the Central and Eastern Europe (CEE) region that saw most cable deal activity with industry buyers most active. Although the value of deals was small, the trend signals an important return to consolidation activity in the CEE market where many country’s cable markets remain fragmented.

The cable industry continued to fight regulators in a number of markets including Belgium and the Netherlands over conditions imposed on open access. In Germany, regulators still seem to take a dim view of full consolidation between KDG and the Liberty Global-owned assets, despite intensifying national competition.

We expect to see continued deal activity throughout 2011 with industry buyers remaining at the fore as private equity buyers look to monetize their now-long-standing cable investments and operators themselves seek out trade buyers who can bring something other than money to the party.

While there has been a slight trend towards IPOs of the larger operators, we believe that this will remain a rarity, used more as a negotiating tool to encourage a trade negotiation rather than a preferred route to market.

Eastern Europe is certain to remain the hotspot of activity, although in the West, continued interest by Liberty in Dutch Ziggo and, perhaps, Germany’s KDG could see some major transactions during the year.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally