International channels to earn $5.5 billion by 2018

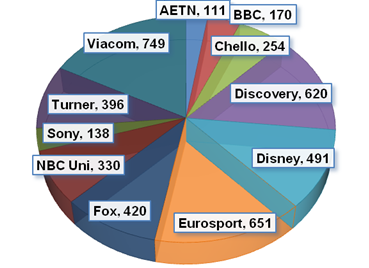

Wednesday, October 23rd, 2013Viacom ($749 million) will reap the highest revenues of any international channel group in Europe in 2013, according to a new report from Digital TV Research. Covering 225 international channels/networks from 11 groups, the TV Channel Revenues in Europe report estimates that Viacom will be followed by Eurosport ($651 million) and Discovery ($620 million).

Revenues for Europe’s top pay TV channels by group in 2013 ($ million)

Source: Digital TV Research

Viacom will remain the largest channel group (growing to $975 million in 2018), again followed by Eurosport ($801 million) and Discovery ($772 million) – (although Discovery and Eurosport may have merged operations by then).

Nicholas Moncrieff, report author, said: “The recession has hurt some regions more than others. The UK is buoyant overall, but no growth is expected in Spain & Portugal and Italy until next year. The estimates and forecasts in this report have been prepared using an analysis of a database of hundreds of financial records.”

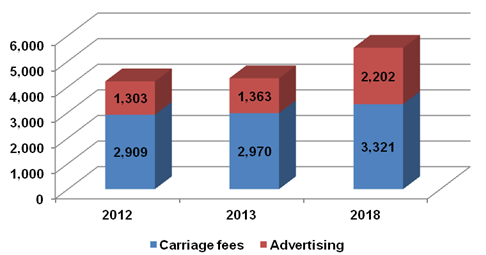

Revenues for Europe’s top pay TV channels by source ($ million)

Source: Digital TV Research

Total revenues for Europe’s top pay TV channels reached $4.21 billion in 2012, and will grow by 31% to $5.52 billion by 2018. Although it provides the bulk of the total, carriage fee revenue growth is slowing as markets mature. Carriage fee revenues will climb by 14.1% from $2.91 billion in 2012 to $3.32 billion in 2018. Advertising revenues will increase by 69% from $1.30 billion in 2012 to $2.20 billion by 2018.

The UK and Ireland combined are the largest country group. Perhaps more surprising to some is that Eastern Europe is already the second largest region, and it is expected to gain ground on the UK & Ireland over the next five years.

More: TV Channel Revenues in Europe

Links: Market Research Store

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally