Pay-TV operators look to 'second screen' apps and enhanced DVR

Wednesday, February 12th, 2014

Pay-TV operators look to ‘second screen’ apps and enhanced DVR in tug-of-war for subscribers

CAMPBELL, California — Market research firm Infonetics Research released excerpts from its latest Multiscreen TV Service Strategies and Vendor Leadership: Global Service Provider Survey, which provides insights into pay-TV operators’ plans for multiscreen video services and delivering live and file-based video content to subscribers with multiple devices.

CAMPBELL, California — Market research firm Infonetics Research released excerpts from its latest Multiscreen TV Service Strategies and Vendor Leadership: Global Service Provider Survey, which provides insights into pay-TV operators’ plans for multiscreen video services and delivering live and file-based video content to subscribers with multiple devices.

ANALYST NOTE

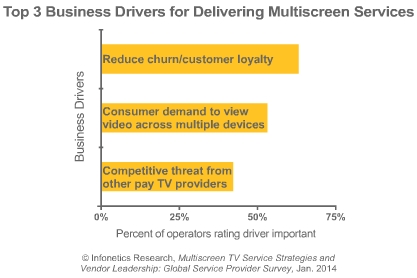

“In a growing number of markets, pay TV providers find themselves at a crossroads,” notes Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research. “Their traditional business models are under attack as telco IPTV providers, over-the-top (OTT) providers, and consumer electronics companies — Netflix, LOVEFiLM, Amazon, Hulu, Apple, Samsung, and others — continue to divert revenue away from them.”

“Pay TV operators are simultaneously grappling with how to address the desire among subscribers to take their content with them wherever they go, whenever they go,” adds Heynen. “The net result is a major change in what equipment pay TV operators invest in to ingest, encode, transcode, and play out video content, as well as how they negotiate with content owners for the right to distribute content across multiple formats.

MULTISCREEN TV SURVEY HIGHLIGHTS

- Value-added services like second screen apps and enhanced DVR capabilities have gained in popularity due to the convergence happening in the living room between smartphones, tablets, and connected TVs

- For most pay-TV providers, the tablet has become the de facto second screen: 47% of respondent operators support tablets as part of their multiscreen service now, growing to 89% by 2015

- Apple’s HTTP Live Streaming (HLS) currently leads video streaming protocols in use by respondents; however, Microsoft’s Smooth Streaming closes in by 2015

- Among operator respondents, Cisco is the most familiar vendor of multiscreen video equipment and receives the highest rankings for a variety of criteria

- Multiscreen is still a relatively new service offering for many pay-TV operators, making it necessary for multiscreen equipment vendors to demonstrate the reliability of their products and provide support to customers

ABOUT INFONETICS’ MULTI-SCREEN SURVEY

For its 35-page multiscreen TV study, Infonetics interviewed purchase-decision makers at incumbent, competitive, and independent wireless operators from North America, EMEA, and Asia Pacific about their plans for delivering multiscreen video. The study provides insights into business drivers and challenges, technological challenges, types of devices and mobile operating systems supported, transcoding and delivery methods, number of live streaming channels and VOD titles offered, value-added services, and familiarity with and ratings of multiscreen vendors. Survey respondents represent 30% of worldwide telecom capex and 24% of revenue. To buy the survey, contact Infonetics.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally