OTT and multiscreen TV drive spending on broadcast and streaming video equipment

Tuesday, June 3rd, 2014

CAMPBELL, California — Market research firm Infonetics Research released excerpts from its latest Broadcast and Streaming Video Equipment and Pay TV Subscribers report, which tracks pay-TV subscribers and video equipment sold to telco IPTV, cable, and satellite TV providers.

ANALYST NOTE

“We are very early in a long-term transition to software-based and SDN-controlled video processing, but we believe the shift will result in increased spending on both multiscreen encoders and content delivery network equipment, as pay-TV and over-the-top (OTT) providers begin purchasing these platforms to more efficiently process and distribute video content,” says Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

Adds Heynen: “Multiscreen and multi-format video give providers the flexibility to deliver video to any end device from nearly every point in their network.”

PAY TV MARKET HIGHLIGHTS

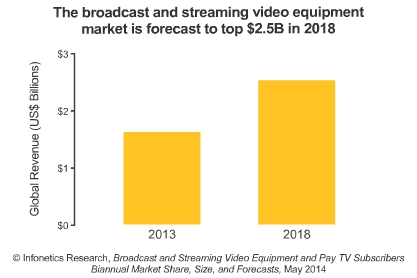

The overall broadcast and streaming video equipment market grew 5.6% worldwide in 2013, to $1.6 billion, as spending on content delivery networks (CDNs) increased while spending on contribution encoders and video-on-demand (VOD) playout servers decreased

The overall broadcast and streaming video equipment market grew 5.6% worldwide in 2013, to $1.6 billion, as spending on content delivery networks (CDNs) increased while spending on contribution encoders and video-on-demand (VOD) playout servers decreased

- Infonetics forecasts the total market to top $2.5 billion by 2018

- CDN platforms are evolving to support an increasing number of over-the-top (OTT) formats such as HTTP Live Streaming (HLS) and Microsoft Smooth Streaming

- Two of the strongest growing segments in the broadcast and streaming video market are CDN edge servers, which Infonetics expects to grow at a healthy 17% CAGR from 2013 to 2018, and multiscreen broadcast encoders, growing at an 8% CAGR

- Pay-TV providers are using a mix of platforms, from GPU-based devices to software only, to create massive and distributed encoding horsepower in the cloud—all managed centrally via software-defined networking (SDN) controllers

- Harmonic Inc. continues to lead the global broadcast and streaming video equipment market, although its revenue share decreased about one point while some competitors gained in 2013

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally