Global SVOD homes to reach 428 million by 2021

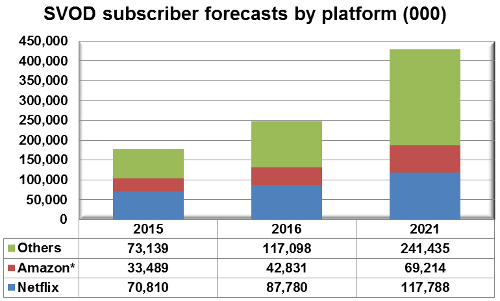

Monday, December 12th, 2016The number of SVOD [subscription video on demand] homes is forecast to reach 428 million across 200 countries by 2021, up from 177 million in 2015 and an expected 248 million by end-2016. The total will grow by 70 million in 2016 alone, according to the Global SVOD Forecasts report.

Simon Murray, Principal Analyst at Digital TV Research, said: “North America supplies most of these subscribers at present, but Asia Pacific will become the top region by 2019. This comes despite Netflix being unlikely to secure direct access in China and only making a limited impact in other major population centers such as India and Indonesia. There are some large SVOD platforms in Asia Pacific that have been active for some time, especially via mobile phones.”

The US (127 million subscribers by 2021) will remain the SVOD market leader by some distance, although China (74 million in 2021 – up by 34 million on 2016) will record strong growth to close the gap.

Source: Digital TV Research

The report forecasts that Netflix will have almost 118 million paying subs by 2021 – or 27.5% of the global total. Although the number of international subscribers will overtake its US ones in 2018, the US will still contribute 44% of its subs by 2021.

Subscription revenues for Netflix will double from $6.37 billion in 2015 to $13.14 billion in 2021. Despite growth elsewhere, North America will still contribute 52% of its total in 2021.

Murray continued: “We estimate that Netflix has distribution partnerships with 79 pay TV, telco or mobile operators across 44 countries. These partnerships include multinational deals with Liberty Global, Millicom/Tigo and Telia.”

Global SVOD revenues will reach $32.18 billion in 2021; 18 times the $1.74 billion recorded in 2010 and up by $20 billion on the $12.20 billion recorded in 2015. Revenues will grow by $5 billion in 2016 alone to take the total to $17.46 billion.

For more information on the Global SVOD Forecasts report, please contact: Simon Murray, simon@digitaltvresearch.com, Tel: +44 20 8248 5051

* Amazon does not directly charge Prime subscribers to receive video content. However, Digital TV Research believes that Amazon is too big to ignore in the SVOD environment. Therefore, Digital TV Research has assumed that 60% of Prime subscribers watch video, so half the Prime subscription fee for these subs has been allocated to video. We have conducted forecasts for Amazon in 22 countries, although it could well launch in more countries.

Latest News

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge

- Virgin Media partners with PubMatic to scale FAST advertising

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services