HTC takes VR lead in China, the world’s second largest market

Thursday, February 16th, 2017

PALO ALTO, SHANGHAI, SINGAPORE and READING (UK) — The virtual reality industry got off to a strong start in China, with around 300,000 VR headsets shipping in 2016, making it the world’s second largest market with a share of around 15%.

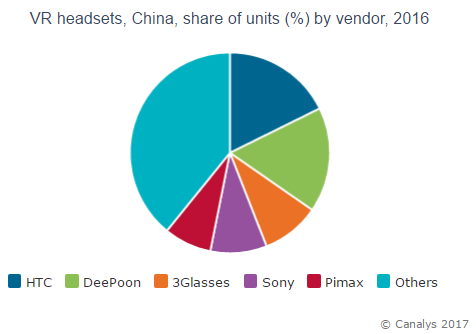

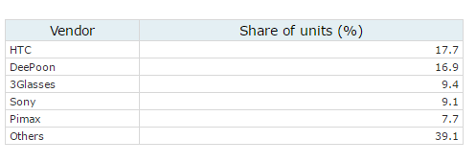

HTC took the top spot, grabbing 18% of the total VR headset market by volume. It shipped more than 50,000 of its Vive headsets in China. Local vendor DeePoon came a close second, taking a 17% share. It has two headsets on the market to compete with HTC. In 2016, almost 70% of DeePoon’s shipments were of its M2, a smart VR headset.

“HTC will need to continue its attack on the B2B market to ensure it maintains its lead. It is supplementing a good product with efforts to build a successful ecosystem by encouraging startups and content makers to produce engaging user experiences,” said Canalys Analyst Jason Low. “DeePoon is chasing HTC in China and owes much to its partnership with Samsung, suppliers of the M2’s silicon and display. This relationship has been vital to lower the cost of ownership of VR systems and maintain the VR experience at a decent level.”

2017 will be a challenging year for local VR vendors. Limited access to resources and an inability to make bold decisions will continue to threaten investor-backed VR firms, which are under pressure to increase both revenue and profitability. “HTC has been able to use its relatively stable financial position to convince the channel and ecosystem partners that it is in it for the long run,” said Low. “Companies such as DeePoon and 3Glasses have now managed to move beyond the consumer market to attract business buyers. They will need to start building their ecosystems, engaging developers to create unique use-cases to give businesses confidence.”

Sony’s consumer focus and low PlayStation 4 installed base led it to ship fewer than 30,000 units, taking fourth place in China despite leading in most other markets. “To boost PlayStation VR demand in China, Sony must ensure its AAA VR content is launched there at the same time as in other countries,” said Low.

VR headset shipment data is taken from Canalys’ Wearable and Virtual Reality Analysis service, which provides quarterly market tracking. Canalys defines a virtual reality headset as a device with a display designed to be worn on the face that immerses the viewer in a virtual world, and it excludes simple viewers, such as Samsung’s Gear VR and Google’s Daydream View. A smart VR headset is a multi-purpose device that is designed to be worn on the face and not carried, runs an operating system, and can run third-party computing applications. A basic VR headset is a device serving a specific set of purposes that is designed to be worn on the face and not carried, cannot run third-party computing applications independently and is generally tethered by cable to a desktop PC.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally